26/05/2021Budgets & Other , Business Growth Ideas

Zero Based Budgeting is a technique used in budgeting that involves preparing the budget from zero base. This method helps companies to align their spending with the company’s goals. Management prepares a budget from scratch that only includes essential expenses and operations to verify that all the components of the annual budget are cost-effective, relevant, and helpful to increase savings.

This budgeting method is used for providing a purpose for every cent used in a business. Here all expenses must be justified to be placed into the budget. For instance, if a business is expecting £20,000 in wages and salaries, and believes that it is necessary for the smooth operation of the business. Then, it needs to be included in the budget. However, the allotment of salary of each employee needs to be examined and justified for including it into the zero-based budget.

Learn more about why budgeting is necessary for your business!

Comparison of Zero Based Budgeting with Traditional Budgeting:

Businesses use budgets to keep track of their expenses and to reduce cost and to increase profit. Generally, budget planning is based on the budget of the previous year, as with traditional budgeting. The traditional budgeting method uses a percentage to meet new goals. This percentage generally lies between 1% to 10%.

Sometimes the budget may be affected by the market and other external factors and may show great upper or lower costs. In such a case, you cannot rely on the previous budget due to the significant change. Therefore, you need to make the entire budget from the scratch and it can be done with zero-based budgeting. Here the company analyzes every expense separately from the start and examines all expenses. Whereas, traditional budgeting only uses proposed new expenses.

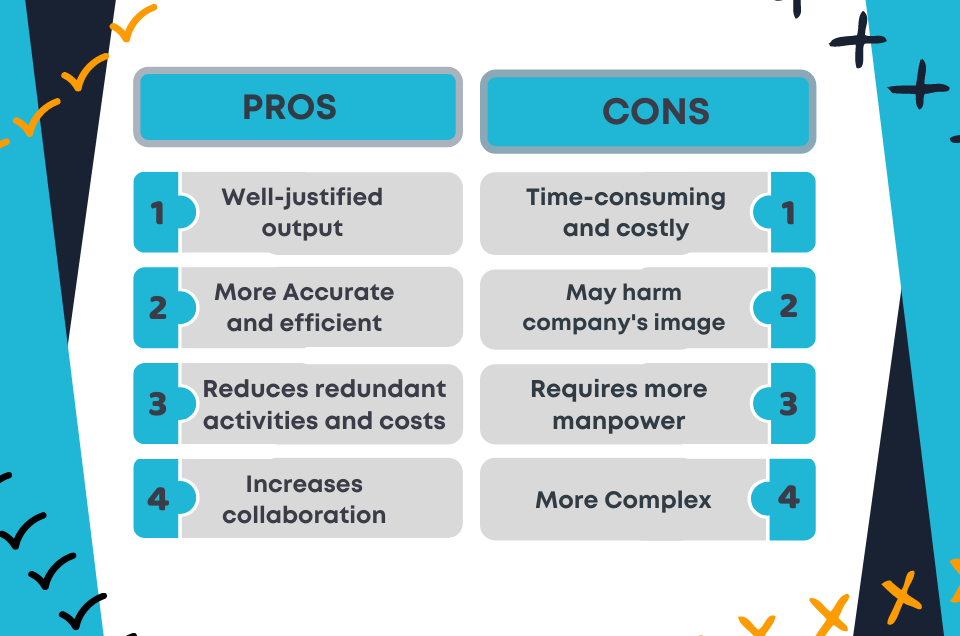

Advantages:

Here are some of the useful aspects of ZBB:

- Well-justified output

- More Accurate and efficient

- Reduces redundant activities and costs

- Increases collaboration

Need help! Reach out to our professionals!

Disadvantages:

Before implementing ZBB, you need to consider its cons:

- Time-consuming and costly

- May harm company’s image

- Requires more manpower

- More complex than traditional budgeting

How to do Zero Based Budgeting?

Businesses can apply their own unique approach, however, here are the basis for implementing ZBB:

- Start from Zero. Prepare a new budget from scratch without using the previous one.

- Examine your cost areas and reduce unnecessary activities involved

- Justify all the components involved in the budget. Find cost-effective and relevant areas

- Streamline what activities your business should perform and how. Automate the processes

- Execute the activities of implementation. Discuss clear plan and roles

Quick Sum Up:

Now that you know the importance and procedure of zero based budgeting, you can give it a shot. If it doesn’t suit your business needs, you should try another method of budgeting. Still, if you are facing any difficulty, you can get reach out to experts for help.

Contact our qualified accountants to prepare a zero-based budget for you!

Disclaimer: This blog provides general information on ZBB.