06/07/2021Accountants , Accountants for Contractors

If you intend to work as a main contractor in the industry, you must register your business for CIS. You are required to verify subcontractors directly to HMRC if they work with you. By verifying the subcontractors HMRC means to keep a track of their registration whether it is already done or not. After registration with CIS and HMRC, it will help to tell the rate of deductions to be made from them. there is a wide range of CIS Accounting Softwares that can help for smooth processing. Before you think to opt for the best possible option available for your business, let’s see what information this blog can unfold for you.

Get in touch with our CIS Accountants for immediate assistance on CIS registration.

This Blog will cover the most frequently asked questions like:

- What Is CIS Accounting?

- Who Counts as Main Contractors and Subcontractors?

- What Kind Of Work Is Covered By CIS?

Construction Industry Scheme (CIS):

CIS is the abbreviation of Construction Industry Scheme which contains a set of rules by HMRC. This explains how the subcontractors that work in the construction industry should get paid. Also, it keeps a track of VAT records and generates reports to have a perspective of your business accounting year.

Under this scheme, the main contractors tend to deduct the amount from the wages of subcontractors working in the construction industry and further send it to HM Revenue and Customs (HMRC). These deductions from subcontractor’s payments are taken as the advance of tax and national insurance. Moreover, the main contractors are bound to register for this scheme whereas the subcontract can or can’t register. However, if subcontractors don’t get themselves registered there are chances of high deductions from their payments.

To verify your monthly returns or to verify a subcontractor, talk to our CIS Accountants at CruseBurke!

Who Counts as Main Contractors and Subcontractors?

Main Contractor: An individual in the construction industry who employs subcontractors is called the main contractor. For main contractors, it is an obligation to get the business registered for CIS as well as to verify the subcontractors from HM Revenue and Customs (HMRC).

Through the process of verifying the subcontractors will help you to know whether they are already registered or not and what is the rate of deduction from their payments. For the subcontractors who are already registered, the deductions will not be high rated and will only be paid to HMRC.

Generate reports to gain perspective on your accounting year and keep a track of VAT with our Accountants at CruseBurke, contact us now!

Subcontractors: The person who works for the main contractor in the construction industry is the subcontractor. CIS Tax deductions are made from the payments of subcontractors. These deductions are your advance to tax and national insurance and when you claim tax returns, it will be taken off if any amount is owed.

In case the business turnover exceeds a certain limit and your previous paid taxes are on time, you can even apply for gross payment status. The contractor will no longer be able to deduct CIS from your payment. Any due tax will be paid at the end of the year.

CruseBurke has an in-depth knowledge of the construction industry and CIS Accounting, contact us to get instant help to get year-end accounts done!

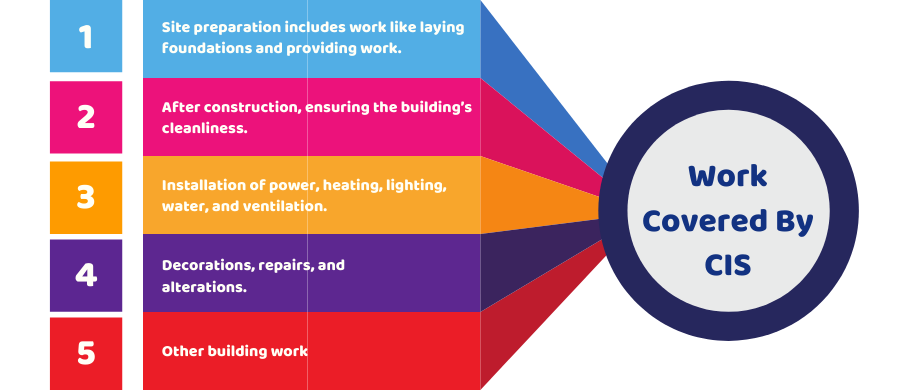

What Kind Of Work Is Covered By CIS?

A major part of the construction is covered by Construction Industry Scheme. It covers permanent as well as temporary building structures. Also, it deals in civil engineering work for bridges and roads.

For CIS purposes, it includes:

- Site preparation includes work like laying foundations and providing work.

- After construction, ensuring the building’s cleanliness.

- Installation of power, heating, lighting, water, and ventilation.

- Decorations, repairs, and alterations.

- Other building work

For CIS Accounting purposes, you are not bound to register if you do certain jobs like:

- Delivery of material used in construction.

- Work like running a canteen or site facilities do not come under construction clearly.

- Making of machinery or plant or any other material used in construction.

- Carpet fixing

- Surveying and architecture

- Scaffolding with zero labour

For further details on what is not covered by CIS Accounting, immediately reach out to our experts at CruseBurke

In case of exception that your business is based outside of the UK, CIS Accounting rules will remain the same but how you apply for registration and pay tax will be a different process.

Conclusion:

I hope this blog helped to provide vivid gathered information and have a better understanding of what is CIS Accounting all about. To tie everything together up, it will not be wrong to say that Construction Industry Scheme is a way of hassle-free processing of the accounting at the year-end only if you follow the set rules religiously regardless of you being the main contractor or the subcontractor.