04/10/2021Business , Business Growth Ideas , Limited Company

You may want to change your company’s share structure by adding a new shareholder, or changing the current percentage of shares between the shareholders; this is where the allotment of shares comes into play.

In the allotment of shares, the company issues and allots shares to new or existing shareholders. The shares can be allotted to both individuals or corporate entities. But what is the reason for allotting shares? To know about it, read this blog till the end.

Talk to one of our chartered accountants in Croydon about the online accountancy services we provide. We are just a click away! If you are confused about the process of shares allotment and you want an expert service for it, then feel free to contact us!

What is the Allotment of Shares?

By the company, the process of issuing shares and then allotting them to new or existing shareholders is known as the allotment of the shares. New Shares are usually allotted when new business partners are introduced in the company.

Most of the companies consider issuing and allotment of shares as the same thing because they follow the same procedure. But keep in mind that these two are different terms unless they follow a similar procedure.

What are the Reasons for Issuing Shares?

The main purpose of issuing shares is to raise funds for a business. Some of the essential reasons to issue new shares are as follows:

- For the repayment of the company’s borrowings.

- In order to raise funds for a company.

- To raise funds for development or for a new project.

- At the time of incorporation of a company.

- To raise funds to purchase a new company or a business.

- To repair the trade continuation and damaged balance sheet of small businesses at the time of financial crisis.

- When shares are granted by a business as a share option to employees or directors.

- When a senior employee becomes a director or a new director joins the company.

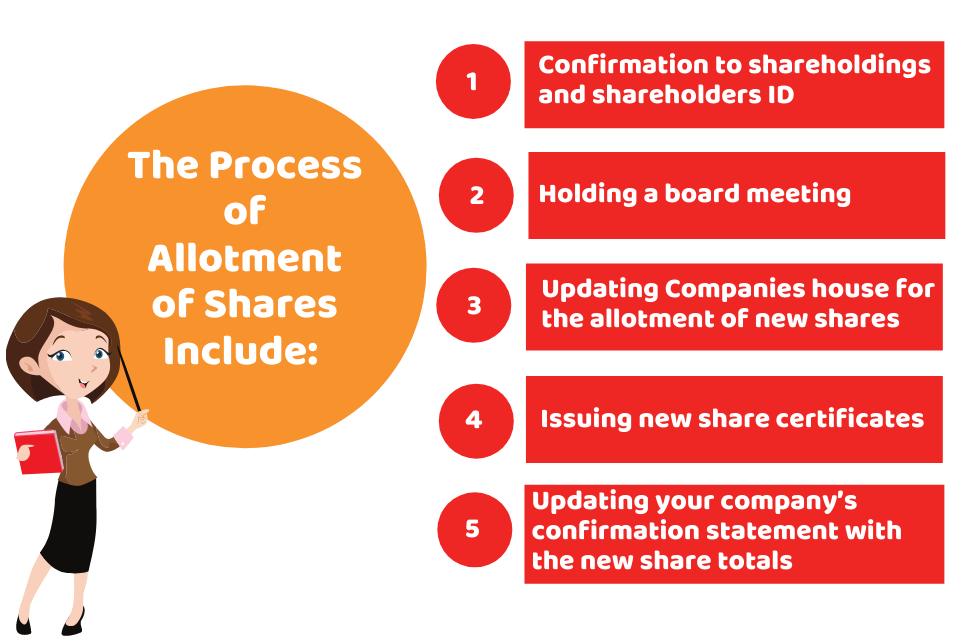

The Process of Allotment of Shares

To allot shares to the new shareholders, all the companies need to perform few specific steps. The following is the procedure for allotting shares.

1) Confirmation to Shareholders ID & Shareholdings

It is mandatory to confirm the existing shareholdings, the shares you are proposing to introduce, and your shareholder’s final shareholding structure. The confirmation of the following details is necessary in order to allot a share to a new shareholder.

- Name

- Date of birth

- Relation with other shareholders

- Residential address

- Nationality

- Proof of the ID

2) Holding a Board Meeting

To hold a board meeting is essential for shares allotment. The changes are required to be approved in the board meeting, after confirmation of the shareholder’s ID and shareholdings.

The information regarding the shareholders and the revised share structure should be included in the minutes of the board meeting. And, it has to be kept secure in the records of a company. These details are then forwarded to the Companies House and they can be utilised as evidence during an audit.

3) Updating Companies House for New Shares Allotment

After the allotment of the shares, the details are required to be reported to the Companies House within one month of allotment. This is done by completing & filling the statement of capital form (SH01). The form can be easily filled out on the website of Companies House. This form is utilised to update the share structure of a company to Companies House. The SH01 form does not include the details of the total number of shares allotted and the details of shareholders.

4) Issuing of New Share Certificates

According to the new share structure, the new share certificates are issued to the shareholders after updating the Companies House of the allotment of the new shares. The details about shareholdings are included in a share certificate. Moreover, the certificates that are issued previously will be cancelled automatically.

5) Updating Company’s CS01 (Confirmation Statement) with New Share Totals

Updating the CS01 with the Companies House is mandatory for you. The new share structure in the company will be displayed after updating it.

In the company’s confirmation statement, you must include the details of a new shareholder. This is because the SH01 form does not contain any details that are related to a new shareholder.

Quick Sum Up

We hope now you have understood what is the allotment of shares, the reasons for issuing shares, and the process of share allotment. Go through the above-mentioned procedure while allotting shares. We recommend you consult with a chartered accountant as the process of issuing and allotting shares is quite technical without the help of a professional.

CruseBurke provides an expert service for the allotment of shares, providing all the required minutes, forms, and documents with practical advice! So, contact us now!

Disclaimer: This article intends to provide general information on allotting shares.