05/01/2022Landlord , Property , Tax Issues

The income you earn from land or property, along with the rental income gained from renting a part of a flat or house (like a single room) is known as property income. It also includes income generated from caravans or houseboats. Similar to other incomes, it is also taxed in the UK, unless the property qualifies for reliefs or allowances. The amount of tax you need to pay on this income will be subject to your income tax band. In this blog, you’ll learn the what are tax rates for property income, what is property income allowance, when you can’t use this allowance and what records you may need to make a claim? Let’s explore!

We save your time, money, and stress by handling all your finances and business problems in no time! Call us on 020 8686 8876 or email us today.

What Tax Do I Need to Pay on my Property Income?

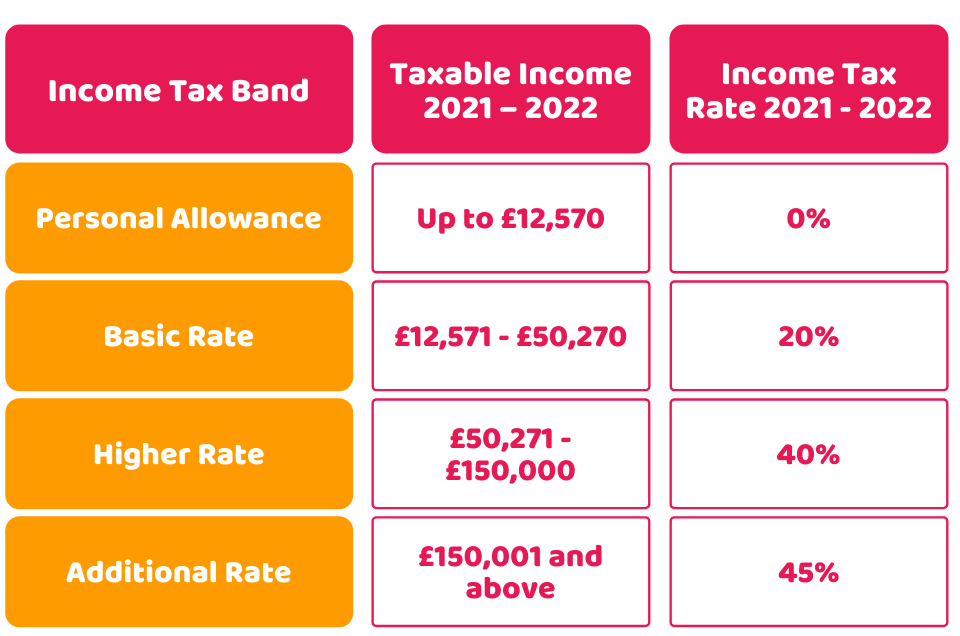

The income tax band determines the rate of tax you need to pay. The rates of property income are the same as those of your personal. However, you may fall under the higher rate band if your property income and other income are added together. Here is the income tax you need to pay as per your income tax band:

What is Property Income Allowance?

It is a standard allowance or tax exemption on which no property tax is payable. Currently, in 2021-22, you get a tax free allowance of £1,000 a year (from 6 April 2017 onward). If your income is below this allowance, you don’t need to inform HMRC or declare any tax return. However, sometimes you need to complete a tax return even if your income is below £1,000. But, if it’s higher you need to declare your property income and complete a tax return. And you may need to file a tax return for other income.

You must inform HMRC if:

- your property income is more than the property allowance from £1,000 up to £2,500

- the property income is more than £2,500, you need to register for self-assessment

Want to register for Self-Assessment? Allow us to do the hassle on your behalf. Save your time by filling out this form and let us handle everything!

In case, your annual gross property income from one or more sources is over £1,000 you can still use these allowances, instead of subtracting any expenses or allowances. With this allowance, you can subtract £1,000 from your income as partial relief which should not be over your income.

If you find that your expenses are over your income, you need to consider availing of expenses instead of the allowance. And, if you own property jointly, you’re each owner is eligible for the allowance as per the share of the rental income.

When You Can’t Use this Allowance?

You are not eligible to use the property allowance if you are making income from:

- employment (your employer/employer of your spouse/civil partner)

- a partnership where you or someone associated with you are partners

- a company owned or controlled by you or someone associated with you

You are also not eligible to use property allowance if you:

- deduct expenses from income by renting a room in your own home, rather than availing Rent a Room Scheme

- claim the tax reducer for finance costs (such as mortgage interest for residential property)

Records to Keep for Property Allowance

You need to keep records of your income to claim for this allowance. Records may include:

- a spreadsheet of your income receipts

- copies of your invoices (both paper or electronic)

- bank statements

- emails indicating income earned

- bank deposit pay-in records

- statements from the company who make payment to you

- a diary/appointments book showing your income from the customers

When Do You Need to Contact HMRC?

You need to get in touch with the Income-tax helpline if:

- you don’t know whether you are eligible for this allowance or not

- you’re not registered for self-assessment and have paid tax via PAYE on some of your property income (you may be due a refund)

Quick Sum Up

So, that’s all about the property income allowance that is £1,000 for the year 2021-22. The tax you will pay on your property income would be the same as your personal income. However, you may fall within the higher rate tax band when your property and other income is combined. You don’t need to file a return if your property income falls below the property allowance. And make sure to keep records to provide HMRC with proof of your property income.

Our property accountants are reliable and transparent. If you need any help with accounting, tax payroll, and other finance-related issues. We will solve your tax issues in no time and at an affordable price! So, contact us now!

Disclaimer: The information is taken from the HMRC and is intended to provide general information.