20/09/2021Accounting , Business , Finance , Limited Company

A company balance sheet contains the term “equity.” But this term is also common in personal finances, accounting, and amongst investors. This blog will inform you about what is equity, its different forms, and why it is essential for businesses and shareholders?

So, let’s start to explore more!

Our accountants at CruseBurke are qualified and cost-effective! We save your time, money, and stress by handling all your finances and business problems in no time! So, allow us to do this at an affordable package!

What is Equity?

The amount of money that can be returned to the shareholders of a company at the time when all the assets are liquidated, and all the debts of a company are paid off is known as equity.

In a publicly listed company, equity belongs to every shareholder, and if the company is limited, it belongs to the owner(s).

What are Different Types of Equity?

A degree of ownership found in any asset after subtracting all the liabilities is generally known as equity. Following are its different types:

Private Equity – It is any stock or additional securities that shows ownership in a limited company.

Stockholders’ Equity – It is the number of funds that are contributed by the shareholders (including profits or losses) on all company balance sheets.

Ownership Equity – It is the amount of money that remains after paying all the debts to its creditors by a company (when it is proclaimed bankrupt and goes into liquidation).

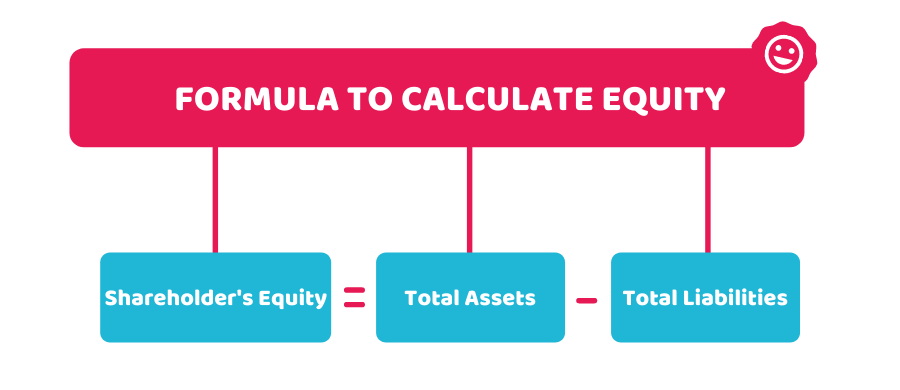

How to Work Out Equity?

The utilisation of shareholder equity usually occurs in the balance sheet and accounting, such as

Total Liabilities + Shareholder’s Equity = Total Assets

The analyst often utilises equity to determine the financial position of a company. You can rearrange the formula as mentioned earlier to calculate the equity.

Shareholder’s Equity = Total Assets – Total Liabilities

Unable to calculate equity? Let us handle this!

Why is Equity Essential for Businesses?

Equity is the most valuable bit of a business that is remained from the total assets once all the liabilities are subtracted. A business is considered more valuable if it contains more equity. They can often use this as leverage for investment.

You also possess equity and a share of the profits when you possess shares in a business. It means that if your business performs well, your profits increase, and so does the value of equity.

So, a private company that needs to raise funds can consider selling shares (equities) within the company.

What are the Equity Risks for Businesses and Shareholders?

Some equity risks are involved for both businesses and shareholders. Those risks are as follows:

1) Investing is a Risk

Purchasing shares in exchange for equity involves risk, like any investment. The businesses may not perform as they planned; therefore, the equity’s value may decrease.

2) It Changes the Business

The selling of equities (shares) means that the original owner (s) of a company must share the profits with other shareholders. It also means that the ownership of a company is shared too.

For example, if you as a business owner want to sell your business equity (share), the other shareholders also have to agree to this. Therefore, sharing ownership can make it more complex to make changes or decisions in the future.

Conclusion

We hope now you have understood the basic concept of what is equity and why it is essential for businesses and shareholders. Equity is important as it represents a company’s financial position, and a business is considered more valuable if it contains more equity. A company can sell the equity to raise its funds, but it must be aware of its risks.

Talk to one of our chartered accountants in Croydon about the online accountancy services we provide. We are just a click away! If you are confused about selling equity, then feel free to contact us! We have the best solutions to all your business problems!

Disclaimer: This blog contains general information about what is equity.