You are required to understand the flow of money through your company in order to calculate the profits and debts accurately. In addition, if you don’t have knowledge of how to move your money then it will be hard to manage the cash flow. And, cost of sales is one of the most important matrices to track for this task (particularly at the time of selling products). Therefore, this blog will let you know about what is cost of sales and how to work out it. So, let’s start!

Get inclusive accounting, bookkeeping, tax, and company formation services with our qualified accountants at an affordable rate. Get in touch today!

What is Cost of Sales?

The amount of money that a company uses in order to make a sale is known as the cost of sales. It is also known as COGS (Cost of Goods Sold). These sales are not similar to expenses. This is because the expenses are not directly linked to the individual sales as COGS do.

Get in touch with our skilled accountants to work out your cost of sales!

What to Include When Calculating COGS?

The COGS may include how much amount of money to pay for the following:

- Raw materials to make products

- Subcontractors providing the core service

- Stock

- Materials for a builder

You should include these expenses even if you do not pay for them at the time of making a sale. It is also essential to know that a lot of company expenditures are allowable. Therefore, you can claim them and can reduce your tax liability.

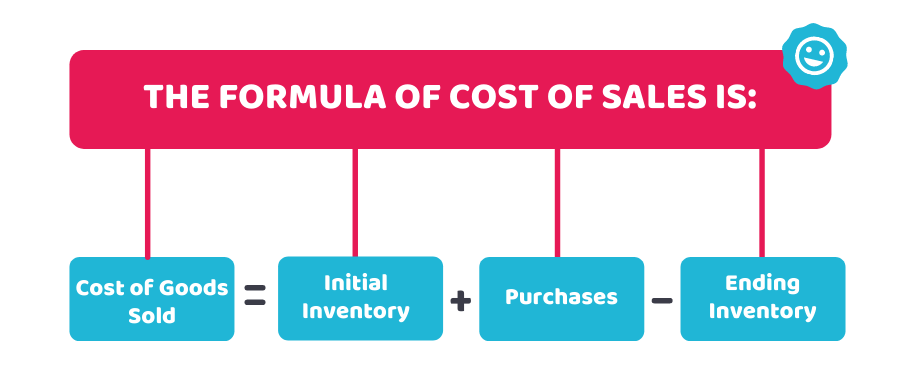

The formula of Cost of Goods Sold

The formula of COGS is as follows:

By the following example, you will understand the formula better.

A company has £14,000 initial inventory. During the month, it has total purchases of £18,000, and at the end of the month, it has £5,000 ending inventory. Now, let’s calculate the COGS with the given figures:

Cost of Goods Sold = Initial Inventory + Purchases – Ending Inventory

Cost of Goods Sold = £14,000 + £18,000 – £5,000

Cost of Goods Sold = £27,000

Unable to calculate the cost of sales? Feel free to contact us! We will calculate your COS in no time and at a reasonable price!

What is the Importance of Cost of Sales?

Knowing how much it costs on making a sale will assist you to figure out how efficiently your company operates, or where it needs more focus. It is also a vital part of working out a gross profit.

Gross Profit = Sales – COGS

Unable to calculate your company’s gross profit? Let us handle this!

Final Thoughts

Now that you know what is cost of sales. We would sum up our discussion by saying that you must consider your initial inventory, purchases, and ending inventory when calculating your COGS. Use the formula we have provided in this article to work out the COGS. This formula will assist you to forecast your cash flow, figuring out your profit margins and maintaining the profitability of your company.

Feel free to contact our professionals if you are worried about calculating COGS! We will work out in no time and at a reasonable price!

Disclaimer: This blog contains general information about what is cost of sales.