12/08/2021Property , Tax Issues , VAT

If you’re a property developer, you can cut down the cost of VAT by reclaiming VAT on property development. But to do it, you need to be well aware of the applicable VAT rules for your development project. With the different VAT rules for new builds, commercial properties, sale, and lease of the property, it can be more complex.

Getting professional advice from a VAT accountant is preferable to get your VAT refunds and to be saved from hefty tax implications that can wipe out your profit. So get in touch with our experts to be on the safe side.

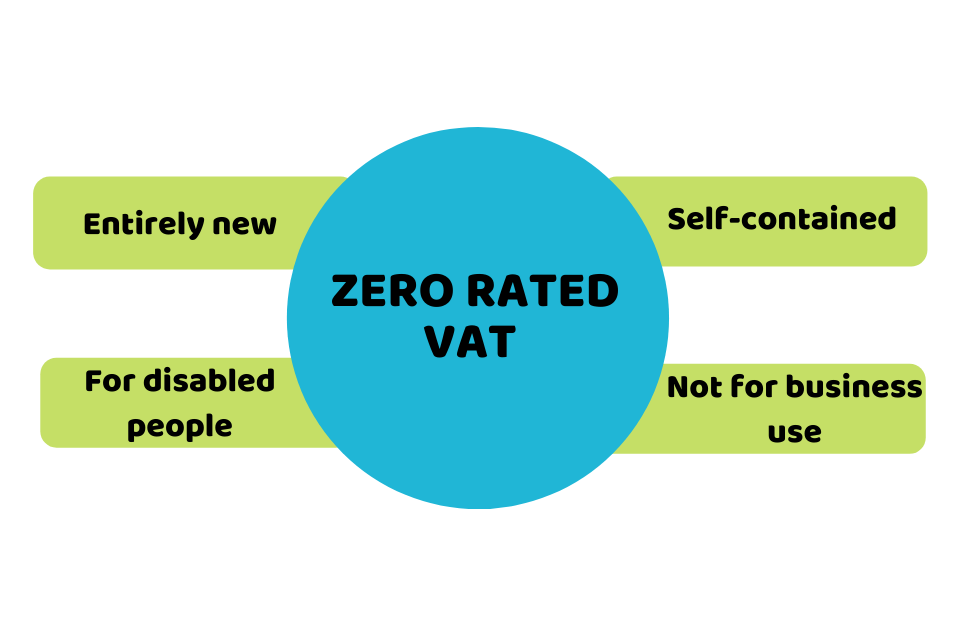

When is Zero Rated VAT Applicable?

If you’re building a new home, the cost of building materials and labour would be zero-rated if the house or flat is:

- Entirely new

- Self-contained, used independently and can be sold on its own

- For disabled people

- Not for business use

If you are charged VAT by your supplier, you can reclaim 20% of the cost. However, you’ll usually be charged at zero rate VAT on your new build. And you can’t pay or reclaim the VAT as there’d be no VAT record on invoices.

Bear in mind that you can’t reclaim VAT on fees charged by professional architects, surveyors, equipment, fitted furniture and certain gas and electric appliances.

Need a VAT Accountant to Reclaim VAT on property development, Contact CruseBurke!

When is Reduced VAT Rate Applicable?

You need to pay a 5% reduced rate VAT if your work falls under one of the below conditions:

- You’re renovating an empty house or flat

- Installation of energy-saving products and certain work for people over 60

- You’re converting a building into a home or flat

- You’re converting a residential flat to another

How Can Developers/ Builders Claim a VAT Refund?

If your business is VAT registered, you have to follow the same process that other businesses do to claim VAT refunds for building projects. You can reclaim the input tax levied on your build project. It is better to view application forms provided by HMRC for new build projects and conversions. These forms show the details needed for claiming a VAT refund.

If you’re a DIY builder and developer, you can claim for VAT return after three months of the building project being completed. Remember that you are provided with only one chance to claim. This claim can be made for most goods and materials purchased from a VAT registered supplier that were used for building work.

Final Thoughts

Reclaiming VAT on property development is not that easy as it is seen. There are plenty of considerations to keep in mind while investing in a property development project. Factors like whether the work is for a new build or a conversion project are also important. Alongside, you need to look at the cost, time, taxes, and risks during the process of property development.

At CruseBurke, we have a team of expert property accountants having a deep understanding of the financial aspects of development projects, especially VAT.

So contact our VAT experts to minimise your VAT liabilities and to get more return on your property investment!

Disclaimer: This blog provides general information on the process of reclaiming VAT on property development.