VAT registered businesses need to charge VAT on their sales and can reclaim the VAT they pay for business expenses. However, claiming back VAT on expenses is not that simple as it seems, there are a lot of complex rules. With these complexities, reclaiming VAT on expenses can be trouble. In this quick guide, you’ll learn when you can and can’t reclaim VAT, how you can reclaim VAT, reclaiming VAT for business vehicles, fuel, and staff travel and can you claim back VAT on purchases made before registration. Let’s explore!

Getting professional advice from a VAT accountant is preferable to get your VAT refunds and to be saved from hefty tax implications that can wipe out your profit. So get in touch with our experts to be on the safe side.

When You Can and Can’t Reclaim VAT?

It is an understood fact that only VAT registered businesses can reclaim VAT on goods and services. If you have paid VAT on the goods and services purchased by the business (input tax), you can make a reclaim. Here are the circumstances under which you can reclaim VAT:

- when a customer leaves you with a bad debt

- you’ve bought goods or services for your business

Things like stock, computers, phones, and stationery are considered business expenses include. You can’t claim VAT on client entertainment.

Here, you need to keep a record of all your invoices and receipts to provide as evidence.

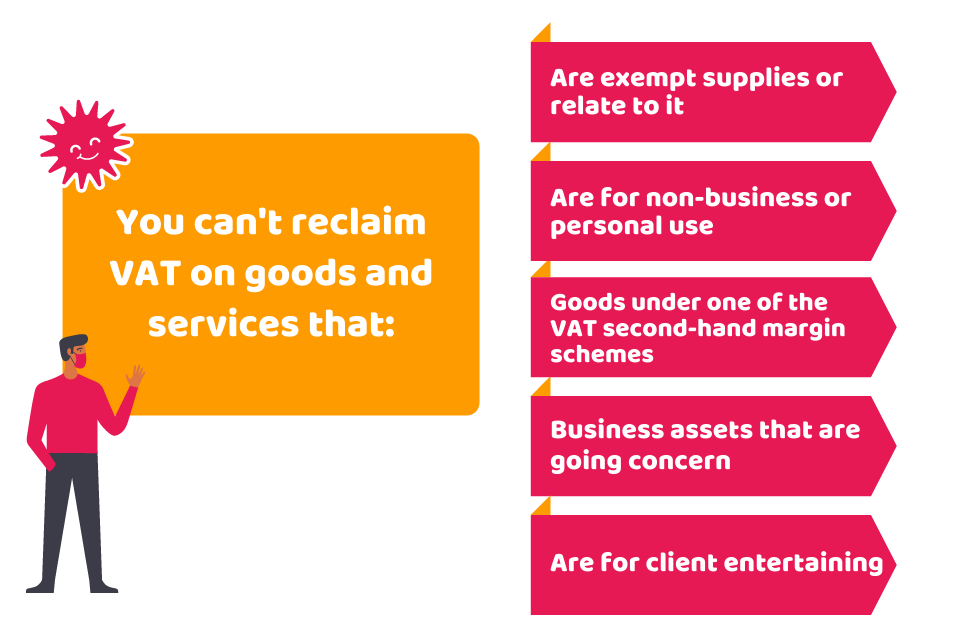

However, you can’t make a reclaim on goods and services that:

- are exempt supplies or relate to it

- are for non-business or personal use

- are for client entertaining

- are for car purchases (exceptions)

You can’t claim for input VAT if you operate a VAT flat rate scheme unless it is related to Capex (capital expenditure) of more than £2,000 (including VAT).

So, as a result, this scheme works better for businesses having fewer expenses (on which VAT can be claimed) compared to their turnover. However, it is not good for those who purchase a lot of standard-rated items.

How You Can Reclaim VAT?

The VAT you claim back will depend upon the input VAT you have paid at the time of submitting your VAT return. You need to include the relevant figure in Box 4 of the tax return. HMRC will subtract this from the VAT charged by you in the relevant period and you’ll be required to pay the difference.

HMRC may repay the amount to VAT you collected if you paid more than you have collected.

Want to get your VAT concerns sorted! We’ll take care of everything. Get in touch with our VAT experts!

Reclaiming VAT on Business Vehicle and Fuel

You can’t claim input VAT on cars, but you can claim it on some vehicles provided some conditions are met. If the input tax on the vehicles is reclaimed by a business, then VAT must be levied at the time of the vehicle’s sale.

Read more about Reclaiming VAT on Business Vehicle

Reclaiming VAT on Staff Travel

VAT can be reclaimed on employee travel expenses (like fuel, meals and hotels). However, you cannot claim back VAT if you pay your employees for flat-rate expenses ( equipment like tools, uniforms and stationery).

Want to register for VAT? Fill out this form and leave the rest to us!

Can VAT be Reclaimed on Purchases Before Registration?

Generally, you can reclaim VAT for goods purchased up to four years before you are registered for VAT. But for services, it is six months before the registration. Here the goods purchased need to be:

- used for taxable business purposes

- still, be held by the business or used to manufacture other goods

Services -to qualify- must also be utilised for taxable business purposes. These may include legal or accountancy fees.

Quick Sum Up

Hopefully, this guide help you ou to understand the process of reclaiming VAT on expenses and how you can reclaim it. In addition, you can also reclaim the goods bought back up to 4 years before VAT registration. Bear in mind that VAT can only be reclaimed on the goods and services purchased for business use. So, you need to keep all the invoices and receipts to reclaim VAT on business expenses.

CruseBurke offers inclusive VAT services at a reasonable price! Contact our qualified VAT accountants and sort out your VAT issues in no time!

Get an instant quote right away!

Disclaimer: This blog provides general information on reclaiming VAT on expenses.