29/06/2021Accountants , Business

If you want to figure out how well your business is performing, one of the most important tools of your annual financial accounts is the profit and loss statement (P&L). A profit and loss statement summarises a company’s sales and expenses typically within a financial year.

You can easily prepare a profit and loss statement using accounting software, but if you are preparing it manually, it can be a bit difficult. For ease, you can get plenty of templates online for preparing a P&L statement. In this blog, we’re going to discuss:

- What is a Profit and Loss Statement?

- What is included in the P&L statement?

- How to prepare a P&L statement?

- Advantages and Disadvantages

Be worry-free about your business finances by getting in touch with CruseBurke!

What is Profit-Loss Statment?

A profit and loss statement is also known as an income statement or the statement of operations. It provides summarised information about the revenue and expenses of your business. Based on your business operation, this statement can be prepared on a weekly, monthly, quarterly or annual basis.

With this statement, you can get a deep insight into the financial health of your business by figuring out the profit or loss your business has made in a certain period. Besides, this statement allows you to compare your business performance in various accounting periods. In addition, you need this statement to work out various financial metrics like gross profit margin and net profit margin.

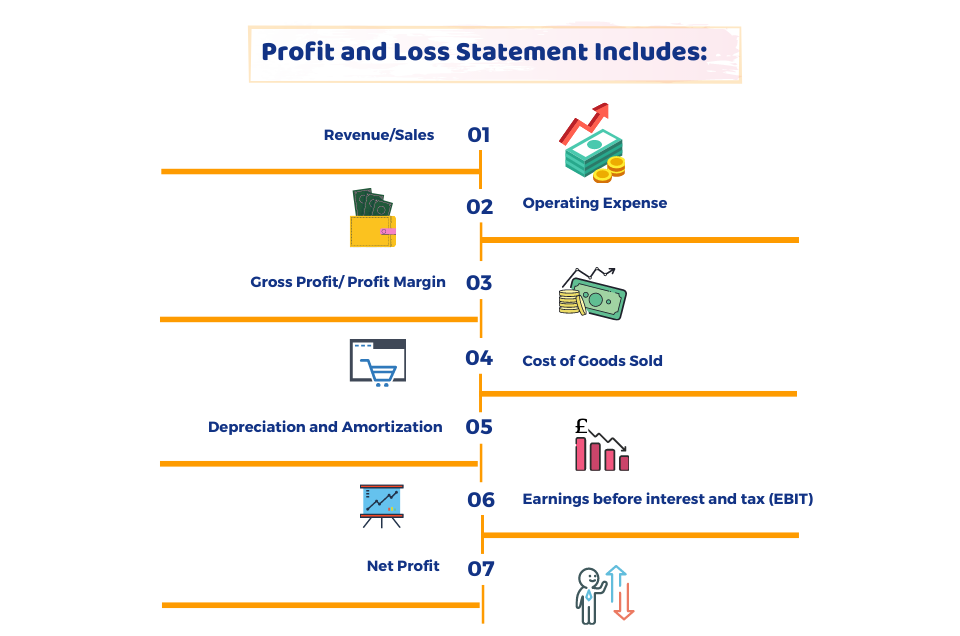

What is included in a Profit and Loss Statement?

This document includes crucial pieces of accounting data that include:

- Revenue/Sales

- Cost of Goods Sold

- Gross Profit/ Profit Margin

- Operating Expense

- Depreciation and Amortisation

- Earnings before interest and tax (EBIT)

- Net Profit

How to Prepare a Profit and Loss Statement?

You can prepare a P&L statement yourself, although many business owners prefer to choose an accountant for proper sequencing and accuracy. The P&L statement needs to provide a clear picture of all the sources of income and expenditures of your business. Here is the basic guide for preparing a P&L statement:

- Choose a timeframe of your statement to get a meaningful date

- List down your business revenue within this period

- Calculate your expenses like COGS, OPEX

- Work out your gross profit by subtracting direct cost from your total revenue

- Figure out whether you’re making money by subtracting your total expenses from the gross profit

If you have all the relevant data, you can prepare it without any hassle.

Steps to Prepare Your Profit and Loss Statement

You can not perform all the calculations by yourself, as some appear to be simple, but they require professional help. However, if you do more work, then your accountant will take less time to finish off. The steps you need to follow are as follows:

- Create a top row for total sales if you are running a trading business or total income if you are running a service business. Create it by utilising your financial management software or a spreadsheet.

- Every column should show a different month, generally beginning from the start of your tax year or from the month in which your company incorporated.

- Some rows below create another row for other business revenue. This can include other revenue like, interests on business investments or savings.

- For “total turnover”, create a third row. It contains the sum of the first two rows (total income, total sales, and other business revenue are added together).

- Insert another row named COGs (cost of goods sold), which includes the total expenses or cost of stock of that month.

- Now add a row for the total cost of sales. In it, you will put the total of your stock purchases or your expenses.

- And, finally, add a row underneath titled “gross profit”. It will contain your total turnover – total cost of sales.

- To give details information about your expenses in different categories, insert a series of rows below it. These categories will contain staff costs, travel costs, marketing & advertising expenses, utilities, insurance, and rental costs, bank and other financial charges, professional fees, depreciation on business assets, office costs, irrecoverable liabilities written off, and other business costs.

- Add all of these expenses, and then deduct this figure from your gross profit or loss. By following these steps, you will get your net profit or loss figure for the accounting period.

Need help from our experts to prepare a P&L statement for you. Contact us today!

Advantages

Here are some of the prominent advantages of P&L statement:

- Track business performance

- Identifies financial trends

These advantages are acknowledged by many accountants and bookkeepers.

Disadvantages

Along with its benefits, there are some disadvantages of it too that can’t be overlooked. These include:

- Requires a lot of work

- Not 100% reliable to gauge the financial performance

Quick Sum Up

To sum up, we can say that it is better to get the help of a qualified accountant to create a profit and loss statement for your business. If you want to prepare it yourself, you are advised to use accounting software to avoid pitfalls.

Get the help of our qualified accountants to prepare a P&L statement for you. Get an instant quote right away!