29/10/2021Business , Finance , Payroll & PAYE

As a contractor, you have two significant options of payroll: PAYE or umbrella company. So, it is essential to make the right decision, whether you are a new or an experienced contractor. That’s why we will focus on PAYE vs umbrella company in this blog. We will provide all the necessary details to you so that you can make an informed decision. So, let’s start!

Are you looking for a professional to help you with employment contracts or understand your responsibilities as a business owner? Then at CruseBurke, we have a team of skilled accountants that provides solutions to all your business problems!

What is an Umbrella Company?

The company offers continual employment to those contractors who are on fixed-term contracts. It acts as an intermediary between the customer and the contractor. With this company, you will stay in employment, when your contract expires, or you’re seeking a new contract.

What is Agency PAYE?

With it, a contractor is employed for the period of their contract with their ultimate customers/clients. They are directly paid via an agency’s PAYE.

When the PAYE worker’s contract with their customer expires, at that time, their employment ends. The PAYE agencies provide lower rates to their workers, while umbrella companies offer higher rates to their employed contractors.

Tackling payroll by yourself is still daunting? Our payroll team can help you out with this. Contact us now!

The Distinction between an Umbrella Company & an Agency PAYE:

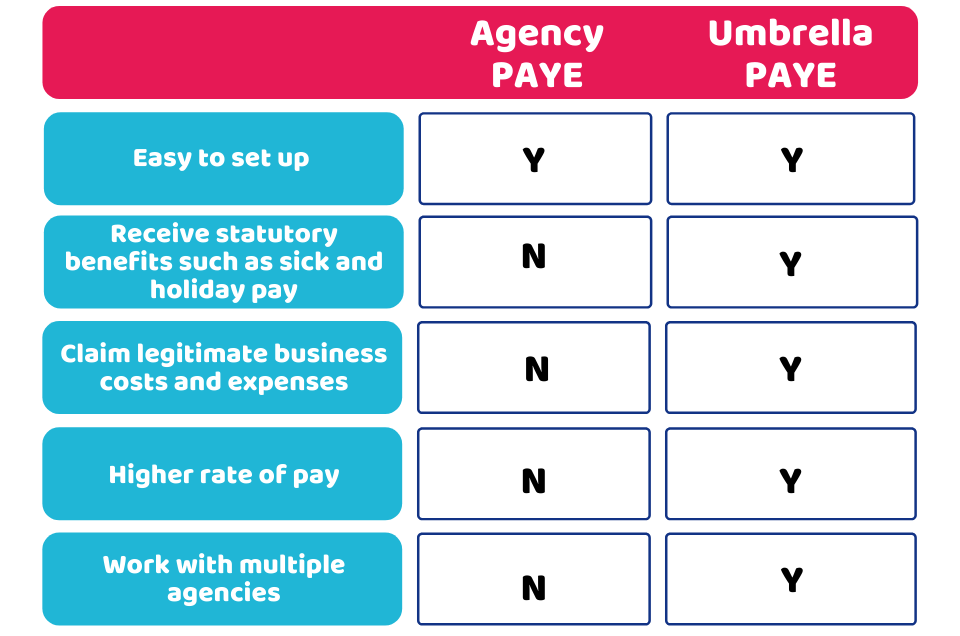

The following infographics will show the distinction between them:

PAYE vs Umbrella Company

You are required to consider the following factors before deciding whether to get paid via agency PAYE or through an umbrella company.

1) Costs

When operating via agency PAYE, there are usually no direct costs. However, in case you opt for the umbrella company, your agency should increase your contracted rate. This is to account for the margin of the umbrella company as well as employment costs. Make sure you have enough knowledge of what is included in this rate in order to compare providers correctly.

2) Expenses

You are hired and paid via PAYE, with both an agency PAYE or an umbrella company. There are no tax returns. However, you can claim tax reliefs on the allowable costs with an umbrella company. When you ask to see whether you are eligible, good umbrella companies will discuss this with you. In case you are, then your tax liability will be reduced.

3) Insurance

You will need insurance regardless of who your employer is. To enable you to do your work, good umbrella companies and agencies will provide any necessary cover. Additional coverage, such as life insurance, health insurance, and accident insurance, can be provided at no additional expense by an umbrella company.

Quick Sum Up

We hope with the above-mentioned PAYE vs Umbrella company difference, you can make a more informed decision on whether to get paid through an Umbrella Company or an agency PAYE. However, if you still can’t make the decision, then we recommend you consult an expert for this!

Allow us to help you make the right decision in order to choose the best option of payroll as per your circumstances! We will resolve all your business problems at a reasonable rate! Reach out to us now!

Disclaimer: This article provides general information on PAYE vs umbrella company.