27/04/2021Accountants , Landlord

Curious to find out the difference between leasehold vs freehold property? This blog post will let you know how you can own the property in different ways. We’ll explore the benefits, cost, and needs of each and how these factors affect the property’s buying, selling, and maintenance costs. Let’s start with the difference.

Leasehold vs Freehold – The Difference:

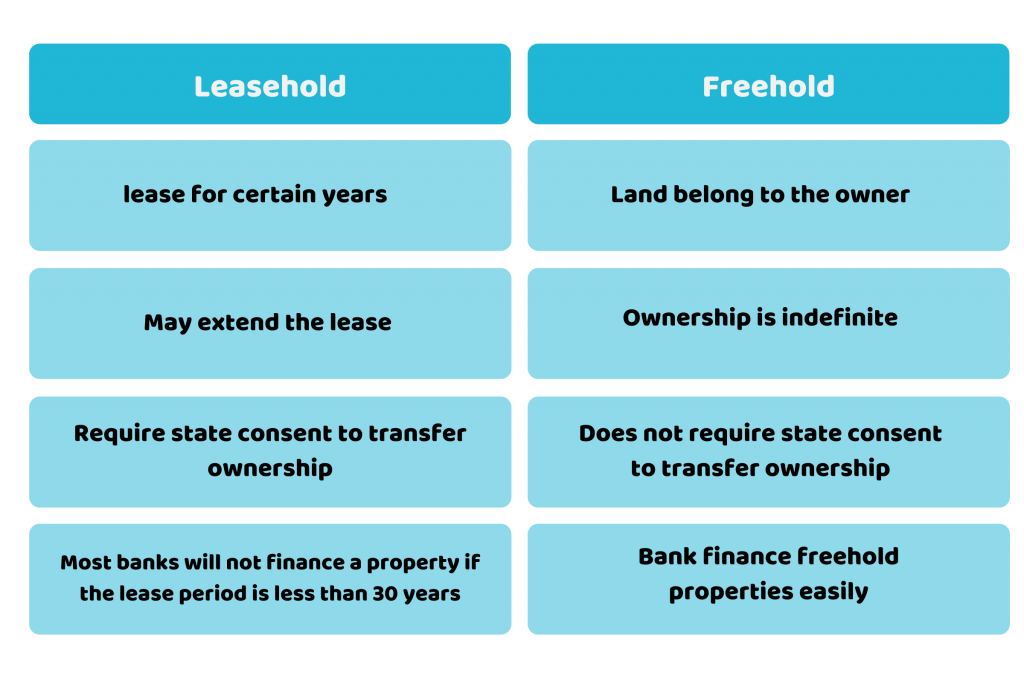

Though there are many differences, the major ones are shown in the below graphic image.

What is Freehold?

As evident by the name, it is a property without the hold of any other entity except the owner. The ownership of this property is totally owned by the freeholder. The property includes the building and the land on which the property is built. As a freeholder, you need to manage both your property and land. Most of the houses are freehold, but some might be leasehold.

Pros of Freehold:

- Here your property ownership is outright and you don’t need to consider the running out time of the lease

- You don’t need to deal with landlords

- You’re free from paying ground rent, service charges, and other charges

Worried about the finances of freehold property, let our accountant handle it!

To find out the difference between leasehold vs freehold, you must know about the leasehold.

What is a Leasehold?

In leasehold, property ownership is subject to the duration of the leasehold agreement with the landlord. You are no longer the owner after the completion of the lease period as after it, the ownership transfers to the freeholder unless it is extended.

Many maisonettes, houses, and flats are owned and sold on the leasehold. You should know that on leasehold you only own the property (e.g building) for a certain period, not the land on which it is built.

Need guidance on leasehold, get in touch with us!.

Leasehold Buying Process:

First, you need to ensure that you get the property ownership from the previous leaseholder.

While taking a property on lease, you should consider the following points:

- Years of a lease; the duration

- How would you manage a budget for service charges and other costs

- How leasehold length affects the mortgages and the resale value of the property

Leasehold Length:

A below 70-year lease agreement might make it difficult to get a mortgage. Lenders require the mortgage period to be at least 25 to 30 years after the end of your mortgage. It means that the duration of the lease should be double the duration of your mortgage. For this reason, selling such property is difficult.

Find out more about leasehold property here at gov.uk

Quick Wrap Up:

Now you can easily differentiate between leasehold vs freehold. Whatever your choice is, you should remember that both of the ownerships have their pros and cons. A leasehold might be favorable to your circumstance while a freehold might be good for another. It depends on the area, law, and individual situations. These factors need to be discussed before finalizing between the two.

For this reason, CruseBurke has a team of certified accountants who have expertise in this field. You can contact us for in-depth guidance and support.

Contact us anytime!

Disclaimer: This blog shows the basic differences between freehold and leasehold.