Find out what is landlord insurance, what are its types, what type of insurance do you need and how much does it cost. In this post, we’re going to cover it all. Let’s dive into it!

What is Landlord Insurance?

Landlord insurance is a category of home insurance that is aimed to cover the loss or damage of rental properties. It also covers the additional risks that occur while letting the property to tenants. You should remember that different policies will have different levels and types of cover. Typically, it covers things like:

- Property damage

- Third-party claims against you if someone is injured or their property is damaged

- Loss of rent

- Contents

Want someone to manage your finances at an affordable rate? Contact us right away!

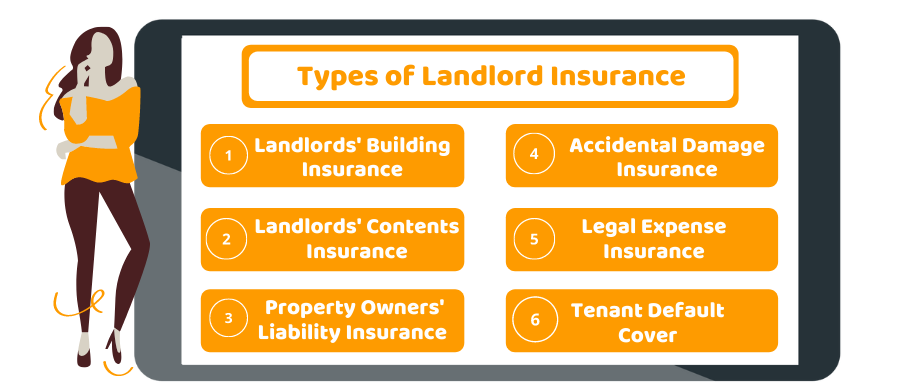

Types of Landlord Insurance

Typically, this insurance policy covers at least building insurance and property owners’ liability insurance. Additionally, you may also get the choice to add other landlord insurance cover to your policy like accidental damage, landlords’ contents insurance and tenant default cover.

Remember that you might not need this insurance on legal grounds, however, your mortgage provider may ask you to have an adequate building insurance policy. Moreover, if you are having a leasehold policy, then your lease might have some insurance requirements too.

Here are some of its major types:

Landlords’ Building Insurance

If you are looking for insurance to cover the cost of rebuilding or repairing your rental property against damage caused by flood, fire or vandalism, you need landlords’ building insurance. If you’re a flat owner where a freeholder is responsible for buying the building insurance, you can opt to get cover for fixtures and fittings.

Landlords’ Contents Insurance

Along with the building, if you want to cover your furniture, appliance and other items, you can add landlords’ content insurance to your policy. You need to remember that this insurance only covers your material possessions. It covers the amount of repair or replacement caused due to:

- Theft

- Damage caused by fire or flood

- Accidental damage ( if you add it to your policy)

Property Owners’ Liability Insurance

This insurance is often overlooked by many new landlords. It is designed to protect you against the legal liabilities in relation to the 3rd party injury or damage blamed on your property. As it is the responsibility of the landlord to maintain the property in a proper way. For instance, if someone slipped on your house floor and suffered a serious injury, the property owners’ liability insurance will cover its compensation and legal cost.

Overcome your financial worries with CruseBurke!

Accidental Damage Insurance

If there is an accident, this insurance will cover the cost of repair or replacement of the contents like a hole in the wall because due to a wrong DIY. If you buy a landlords’ building insurance, then you can add this insurance for the protection of your building against accidents. On the other hand, if you buy landlords’ content insurance, you can enhance it with accidental damage cover for contents.

Legal Expense Insurance

This insurance covers the cost of legal actions that you need to take for the protection of your rental property like getting unpaid rent or evicting your tenants.

Tenant Default Cover

If your tenants do not pay their rent for two consecutive months or more, you can protect your rental income with the tenant default insurance. It can cover your rental loss of up to £2,500 for six to eight months.

What Type of Insurance Do I Need?

There are multiple types of insurance available, so it might be difficult to choose the insurance policy that suits your circumstances. Few things that you need to bear in mind while purchasing landlord insurance are the following:

- Is your rental property furnished or unfurnished? You need to take contents policy along with the building cover if your rental property is furnished. If it is not furnished, you need to consider things like expensive furniture or garden items that are difficult to be replaced. Then you need to decide your policy accordingly.

- Do you have a portfolio of properties? If you own a large number of properties, portfolio insurance is going to be a cost-effective solution for you.

- Do you depend on your rental income? If you are financially dependent on your rental income and have many commitments to fulfil, then considering a rent protection policy is worthwhile.

These are some of the basic considerations while choosing this insurance package. However, it is advisable to talk to an insurance expert to get the most suitable policy as per your needs.

Save your taxes with our tailored accounting services! Contact now!

How Much Does it Cost?

Typically, this insurance is a bit costly than standard home insurance as there are more risks involved. However, the exact price of the insurance may be impacted by various factors like:

- Location: There are some places where there is a greater risk of damage, floods, crimes etc. So the prices of insurance for those places might be higher than others.

- Property Size: If you own a large property, you have to get a higher cover for it. Consequently, you have to pay a large premium for it.

- Tenants: There are some categories of tenants for which you need to pay a high premium like if you have to rent out a place for student accommodation, you have to pay more.

- Type of Landlord Insurance: Along with it, the type of cover you want to take may affect the cost of the insurance.

Quick Wrap Up

Choosing landlord insurance can be complex if you’re unaware of its nitty-gritty details. If your rental property is on the mortgage, your mortgage provider might ask you to buy this insurance. You have the right to choose the type of insurance as per your circumstances. Still, if you are struggling to choose the type or level of insurance, our experts are here for your help.

For further queries, reach out to our accountants for help, we’ll get back to you in the fastest possible time.

Disclaimer: This blog provides general information on the above topic.