10/06/2021Limited Company

Want to find out how to set up a limited company with HMRC as a non-UK resident? Don’t worry, the process is pretty simple, even if you’re a non-UK resident. As application process and legalities are the same for both UK and Non-UK residents.

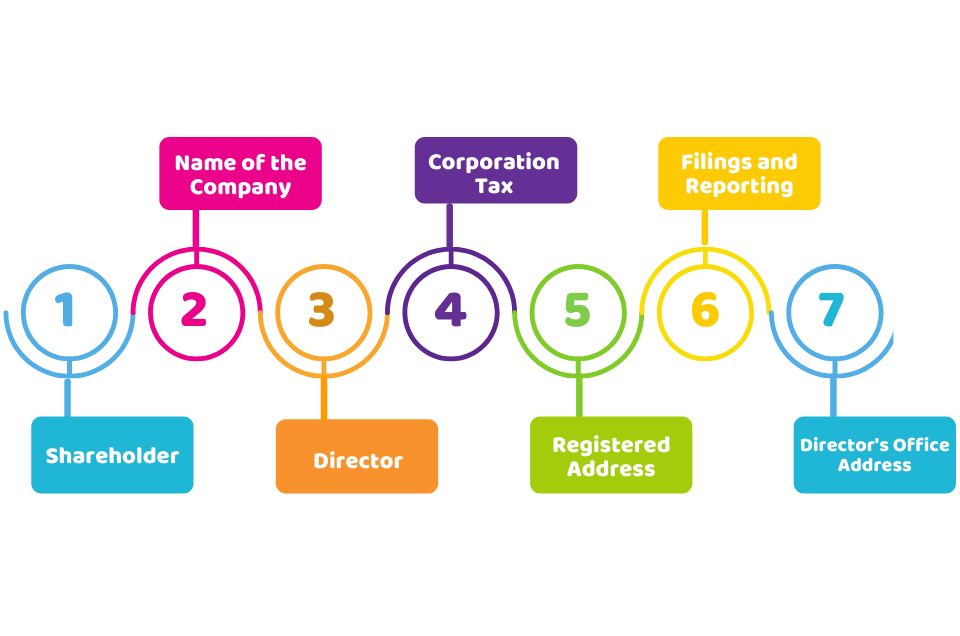

Follow the below steps to set up your Limited Company?

Want to set up your Limited Company within few hours? Provide us with the details and we’ll get it done for only £120. Contact us now!

Registering a Limited Company with HMRC as a Non-UK Resident

You first need to register your Limited company at Companies House in England, Wales, Scotland or Ireland. You’ll form your limited company in these jurisdictions. However, you have the choice to trade across the UK and overseas. You need to follow these requirements for forming a limited company with HMRC as a non-UK resident:

1) Name of the Company

For registering a company, you need to have a unique name for it. But bear in mind that it must not contain any sensitive words.

2) Director

You must have at least one director for forming a limited company. There is no standard limit for the number of directors. You can’t be a company director if:

- You’re below 16

- Undischarged bankrupt

- Disqualified for becoming a company director

3) Shareholder

Alike a director, one shareholder is necessary for setting up a limited company. You can appoint more than one shareholder as per your choice. An entity or individual can be a director or shareholder. While registering your company, you need to provide a certain number of shares to the shareholders.

4) Registered Address

Your limited company address needs to be in the UK that will appear in the public register. All the posts from the Companies House and HMRC will be sent to the registered office address of the LTD.

5) Director’s Office Address

Whether you are a director, secretary or PSB, you need to provide your service address for Companies House. This information can be on the public records. Any legal documents to the directors will be sent to this address.

6) Filings and Reporting

After registration, you are required to submit annual accounts and confirmation statement on annual basis.

Need help with filing or reporting or taxes? Reach out to our certified accountants!

7) Corporation Tax

Your company needs to register to HMRC for paying corporation tax after it starts trading.

Ways to Incorporate a Limited Company:

You can incorporate your limited company by:

- By taking services of an approved company formation agent like CruseBurke

- Online through Companies House for the incorporation process

- You can also apply by post to Companies House

We will set up your company within 3 to 6 hours online if the information provided before 12:00 noon.

Visit our website for further details on company formation packages.

How We can Help

CruseBurke has a team of Limited Company Accountants in Croydon, they will help you to establish a limited company in the UK with compliance to the HMRC and Companies House. Our company formation packages start from just £120 and we’ll cover the following services:

- 3 hour Online Formation- if the information provided before 12:00 Noon

- Full Trading Company – Limited by Shares

- Barclays Bank Account – For UK Residents

- Digital Documents by Email Includes Incorporation Certificate

- Memorandum & Articles of Association

- Companies House £15 Fee included in price

- Free Online Company Name Search

- Free Accountancy Consultation by our experts

- Web Filing Authentication Code

Our Gold and Premium packages provide additional services including:

- Registered Office – London SM4 or Chelsea Address

- Bound Memorandum & Articles of Association

- Maintenance of Statutory Books & Annual Return

- Company Register

Now, without any hustle, you can easily set up your limited company with HMRC as a non-UK resident with us.

So, set up your limited company now with CruseBurke.

OR

Talk to our accountants for further queries.

Disclaimer: This blog provides general information on company formation.