26/08/2021Tax Issues , VAT

After 31st December 2020 – the end of the British transition period – there have been few changes in the VAT system of the UK. In this blog, we’ll have a look at how much is VAT in the UK 2021-22, what are VAT changes, and how to calculate what you need to pay. Let’s dive into it!

Need professional advice from a VAT accountant? Get in touch with our experts today!

How Much is VAT?

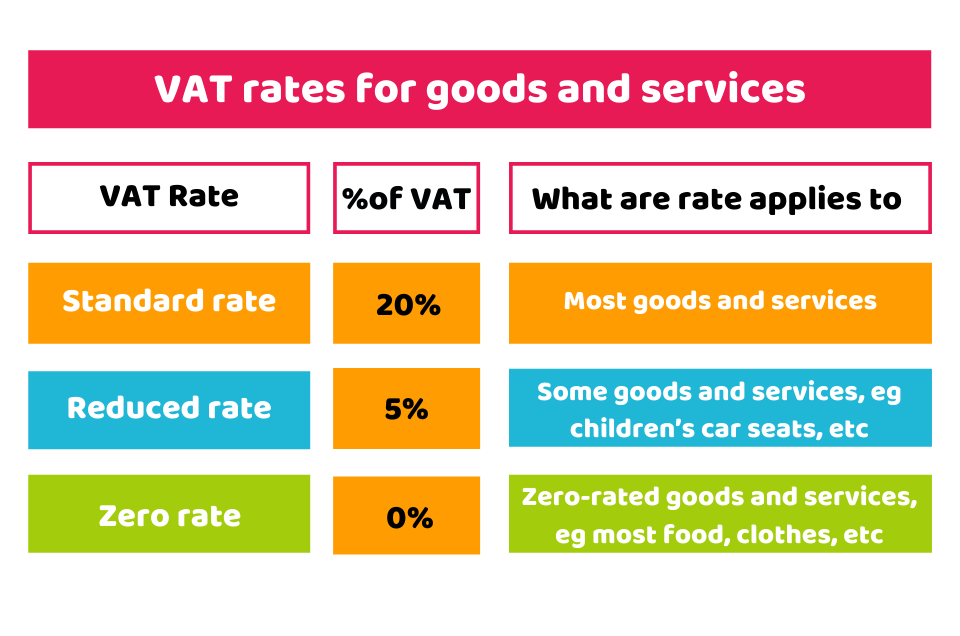

Let’s see how much VAT you need to pay in the UK in 2021-22. Three different VAT rates are charged on various types of goods and services in the UK.

Standard Rate (20%)

Currently, the standard VAT rate of 20% is levied on most goods and services. This rate is also applicable to those goods that are below the standard distance selling EU VAT threshold sent from Northern Ireland to a non-VAT registered EU client.

Reduced Rate (5%)

A reduced rate VAT is 5%. Some of the goods and services are charged at a reduced rate, like:

- Home energy

- Children’s car seats

- Mobility aids for seniors

Zero Rate (0%)

As evident by the name, it means that it is charged at a 0% rate. It means that your customers will pay you 0% in VAT. However, still, you need to record and report it in your VAT returns. Some of the common examples of zero-rated goods are:

- Basic food items

- Books & newspapers

- Children’s clothing

- Most goods sent from Great Britain to countries outside the UK

- Most goods sent from Northern Ireland to countries outside the UK and EU

Along with these rates, there are some goods and services on which you don’t need to pay VAT means they are exempt from VAT. Postage stamps, financial and property transactions are common examples of it. However, you don’t need to include it in your taxable turnover.

You need to bear in mind that the VAT rates keep on changing, so you must be up to date with the VAT changes.

Want to register for VAT? Today Register For Vat without any hassle, at CruseBurke.

VAT Changes in the UK After 2021

Few VAT changes have been made at the start of 2021. HMRC has brought some reforms in the e-commerce industry by involving an online marketplace for VAT on some transactions. Here are some of the major changes made for VAT:

- The UK customers need to know that now there is no £15 VAT exemption on the goods that are sold online to the UK customers. So, imports would be levied a standard UK VAT rate of 20%.

- Sales VAT is payable at the point of sales (POS) on imported sales that are below the threshold of £135. With this, the hassle of customs paperwork at the arrival of the goods would be softened.

- Online platforms have the responsibility for handling VAT. These include sales valued below £135, along with any sales in the UK by the overseas third-party sellers.

These measures are taken by the UK government to make the customs process for imported goods more efficient. In addition, it has eliminated the VAT exemptions on low-cost imports that is bad news for the UK retailers.

Do you Need to Charge VAT on Exports to the EU?

If you’re selling goods to EU customers and you’re a VAT registered business, the good news is that you can sell your goods at a zero rate. From 2021 onwards, the goods you send to EU member states will be treated equally as the goods that come from a non-EU country. However, import taxes are payable on them. As goods, services of the UK supplier will be considered same as the supplier outside the EU.

Summing Up

To sum up, you have understood the VAT changes and reforms that have recently been made. In addition, to find out the answer to ‘ how much is VAT payable in the UK’ you need to look at various factors like the business platform, size, nature and the location of your customers, etc. VAT can be a complex area for many, therefore it’s better to get in touch with a tax expert for help.

So, look no further other than CruseBurke! Contact our qualified VAT accountants and sort out your issues!

Get an instant quote right away!

Disclaimer: This blog post provides general information on VAT.