15/11/2021Accountants , Accounting , Accounting Issues , Startup accountants

Wondering how much does an accountant cost in the UK? There is no fixed cost, it depends on a lot of factors. A fee of an accountant can differ based on the business’s nature, size, and turnover. It also varies as per the service and its scale. In addition, the charges of an accountant may be different as per the location, experience, and expertise of your accountant. After knowing these things, you can gauge the fee of your accountant easily. Let’s find out the average fees of an accountant as per the services!

Talk to one of our chartered accountants to know what they charge! Feel free to contact us!

What Accounting Services Do Small Businesses Need?

If you are a sole trader, contractor or a limited company with up to 50 employees or below, these are the typical accounting services that you might need:

- Bookkeeping

- Annual accounts

- Tax returns

- VAT returns

- Company Formation

- Preparing Financial Statements

- Preparing and Filing Business taxes

- Monthly & annual payroll returns

- Advice on tax avoidance legislation (IR35)

- Day-to-day advice from your accountant

What services you are looking for? Let us know! We have a special offer for you. Get in touch now!

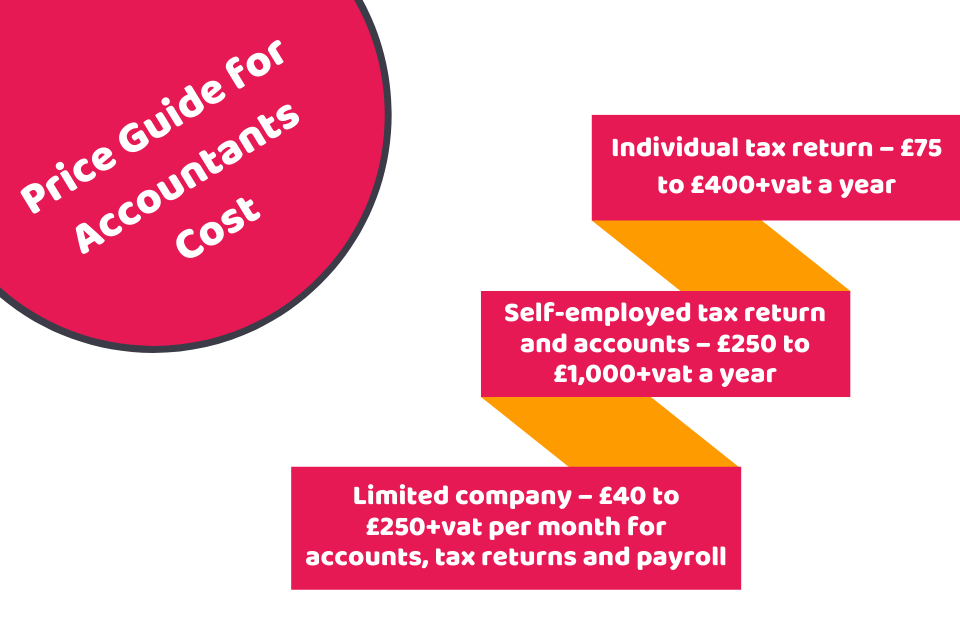

Price Guide for Accountants Cost

Here are the average fees of an accountant. However, these may vary based on multiple factors like your business size, the complexity of your finances, etc. The cost of an accountant as per the industry for the following services is:

- Individual tax return –£75 to £400+vat a year

- Self-employed tax return and accounts – £250 to £1,000+vat a year

- Limited company – £40 to £250+vat per month for accounts, tax returns and payroll

How Much Does an Accountant Cost for Small Businesses?

The services of an accountant vary based on the below-mentioned factors:

- The country you are based in

- Services you need

- Size and nature of your business

For a small business (below 50 employees) looking for the services like tax advice, bookkeeping, monthly and annual payroll, the average fee of an accountant can be anywhere between £60 to £250.

Most self-employed people need an accountant for one-time service, like to do tax returns. There would be a one-off fee for it that will be around £150 to £400. Bear in mind that this is the average fee. This may vary as per your circumstances, complications and other factors. For additional services, the self-employed person needs to pay more.

Self-employed people can save a lot of tax by hiring an accountant. So even after paying the fee of an accountant, you can save money. For VAT returns, this fee can be between £100-£250, and business accounts can range from £150-£700, as per the turnover of the business.

How Much Does an Accountant Cost on an Hourly Basis?

Some accountants charge on an hourly basis. An accountant who is offering basic accounting services will cost you around £25 and £35 per hour. If you need complex services like tax planning and business advice, the charges can go up to £125 to £150 per hour.

Accounting Fees Per Service

Some businesses pay accountants based on the services they want. It may include year-end accounts, VAT returns or payroll etc. Here is the one-time fee for the following services:

- Doing accounts of a business with a turnover of £20,000 to £30,000, the cost will be around £150 (businesses with high turnover need to pay more)

- The typical fee for payroll services with 50 employees can be £200 (per month)

- A business, having a £100,000 turnover, looking for VAT returns will pay, typically, around £100 (the fee will be higher as per the turnover)

Quick Sum Up

So you have now got a fair idea of how much does an accountant cost in the UK. Bear in mind that the accountant’s fee varies based on multiple factors. But as a general rule of thumb, the higher your turnover or income, the greater your accounting fee is likely to be. Remember that the charges mentioned in this blog are just for your general guidance. You may talk to our accountants to discuss the fee, they charge. Moreover, you can minimise your accounting fee by maintaining your records and by using accounting software.

At CruseBurke, we have a team of skilled accountants who provide solutions to all your business problems! Reach out to us today!

Get an instant quote from our accountants for the services you’re looking for!

Disclaimer: This blog provides general guidance on the cost to hire an accountant.