05/11/2021Personal Tax , Taxation , VAT

VAT can be complicated, especially for the one who has just started out. Newcomers face a lot of difficulties to understand financial technicalities and jargon. Among those complex terms, the VAT is the one. Many business owners come across this term a lot while purchasing goods and services as private individuals from businesses. But only some of them are familiar with what actually is VAT, how does VAT work and how to charge and claim VAT. Let’s find out all in this short blog.

Want to register for VAT? Fill out this form and leave the rest to us!

What is Value Added Tax (VAT)?

It is a general consumption tax that consumers need to pay for almost all goods and services in the UK. In simple words, it is an additional amount on most purchases for consumers. Any business operating within the UK with an annual turnover over the VAT threshold (£85,000 in 2021/22) is required to register for VAT and need to submit a VAT return. However, businesses below this threshold can voluntarily register for it.

This is an indirect tax collected by the businesses on the government’s behalf. As they add VAT on all their goods and services, then they send the VAT paid to HMRC. They charge this tax on the items and services they sell to their customers and pay VAT on goods and services they buy from other businesses.

All VAT-registered businesses need to keep records of the VAT charged and paid to others.

How Does VAT Work?

VAT is levied on most of the goods and services. Businesses that are VAT registered save a lot of money by charging VAT on the goods and services they sell and pay VAT on the things and services they use.

Instead of sending VAT charged on every single transaction, businesses submit a VAT return to HMRC showing the total VAT they collected and paid in a tax quarter or year (as per the scheme). The VAT paid by a business to its suppliers is known as input tax and the VAT collected from other businesses is known as output tax.

The amount of money you need to pay to HMRC will depend upon the difference of VAT you paid and charged. In case, if you collected more VAT from your customers than the VAT you paid, you need to pay the surplus to HMRC. On the other side, if you pay more VAT to your suppliers than you receive from your customers, you can request HMRC to reclaim the additional amount.

Need help a VAT Accountant to Reclaim VAT, Contact CruseBurke!

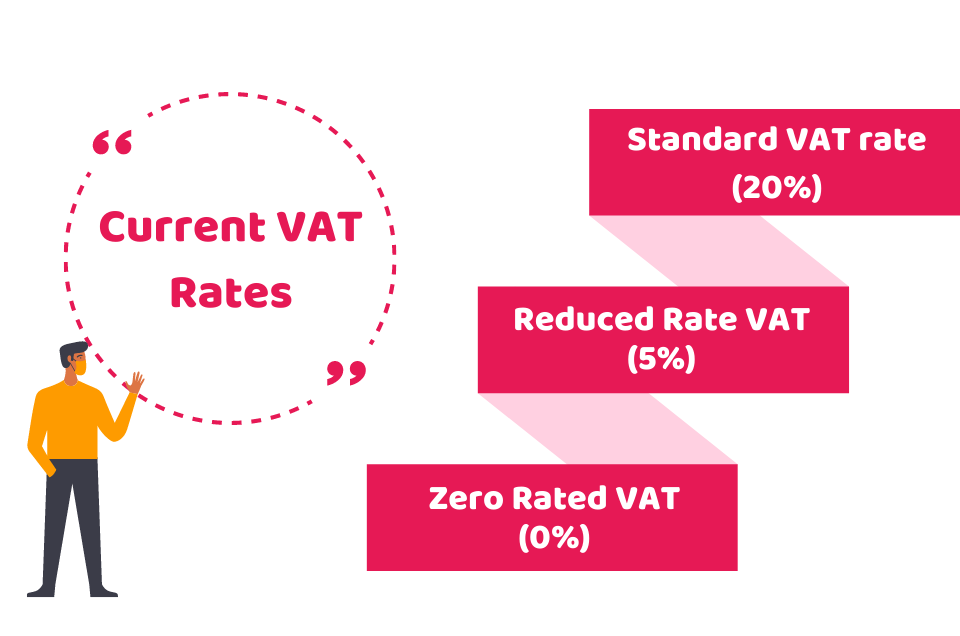

Current VAT Rates

You need to be aware of the current VAT rates you pay and collect to reclaim the VAT on products you buy for your business. There are currently three VAT rates depending on the goods and supplies you deal with. These are:

Standard VAT Rate (20%)

A standard VAT rate of 20% is applied on most goods and services that fall under the category of luxury items like ice cream and sweets etc.

Note: Due to Covid, you need to pay temporarily reduce the rate of VAT on supplies relating to hospitality, accommodation, or admission to certain attractions (Currently it is 12.5% from 1 October 2021 to 31 March 2022). For more details click here.

Getting professional advice from a VAT accountant is preferable to get your VAT refunds and to be saved from hefty tax implications that can wipe out your profit. So get in touch with our experts to be on the safe side.

Reduced Rate VAT (5%)

This rate applies to some specific goods. It is charged at the rate of 5% on goods like domestic fuel and power, etc.

Zero Rated VAT (0%)

Goods that are considered essential are charged a 0% VAT rate. It includes:

- Basic Food items

- Newspaper

- Books and newspapers

- Clothes of children

The goods supplied to non-EU counties and VAT-registered EU businesses would also be charged a zero-rated VAT. You need to keep records of it and report them on your VAT return.

Exempt Items

There are some goods and services that are totally exempt from VAT like:

- training and education

- insurance, medical, finance, credit

- selling, leasing and letting of commercial land or buildings

- subscriptions fees to membership organisations

- fundraising events ( managed by charitable organisations)

How We can Help?

So you are now well aware of what is VAT and how does VAT work. Remember that this blog just serves as a basic guide for you. We have not discussed the complex VAT issues here. Our team of VAT experts are there for your assistance with anything complicated. From VAT registration, submission of VAT returns, consultation to complex issues like assessments, cross borders transactions, our VAT experts will help you with everything.

For further queries on VAT, reach out to our accountants for expert advice. Get in touch today!

Disclaimer: This blog provides general information on how does vat work.