20/05/2021VAT

If your business charges additional VAT from customers on your goods against the VAT it pays to buy things, the difference must be paid to HMRC. Contrarily, if your business is paying more VAT than it takes from its customers, you can reclaim the difference from HMRC. But, the Flat Rate VAT Scheme works differently, this is what are going to discuss today.

Many businesses levy Value Added Tax (VAT) on the sale of their goods and services that are taxable. VAT registered businesses are responsible to have a record of the full value of their sales. The record of VAT that is paid and charged must be reported to HMRC through VAT returns, generally on a quarterly basis.

Looking for VAT advice, get in touch with our accountants!

Understanding Flat-Rate VAT Scheme:

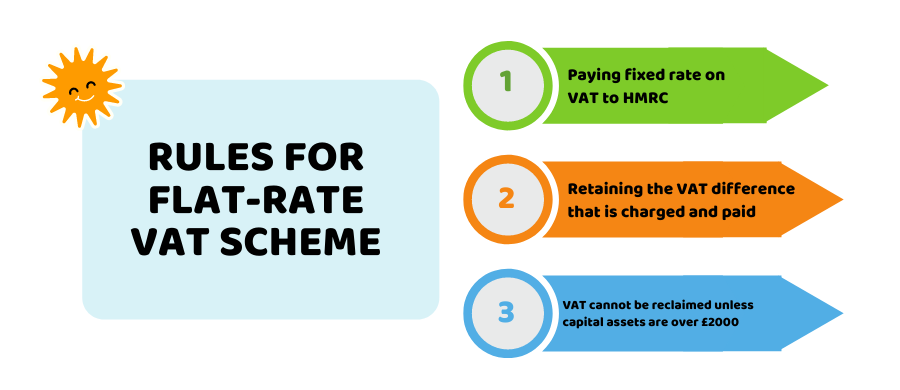

The idea of Flat Rate Scheme is similar to standard VAT paid and charged by a business. However, the rules vary for the businesses that are registered under the Flat Rate VAT scheme. These include:

- Paying fixed/flat rate on VAT to HMRC

- Retaining the difference between the fixed rate paid to HMRC and VAT charged to the customers

- The VAT that is paid to the suppliers cannot be reclaimed by these businesses unless they possess certain capital assets over £2000

Which Businesses can Register for this Scheme?

Businesses that are having a turnover exceeding £85,000 need to register for the standard VAT scheme. You can voluntarily register for VAT if you are below the VAT threshold.

However, the Flat Rate VAT is different from the standard VAT scheme. To register for this scheme, your taxable turnover needs to be above £150,000. Though, you can opt for this scheme as long as you are expecting your turnover to be above the threshold in one year. After exceeding the threshold, you have the choice to leave this scheme.

Curious to know more about the VAT Flat Rate scheme, feel free to reach out!

How it can Benefit my Company?

To find out whether this scheme is going to be beneficial for your business, you need to consider various points beforehand. Therefore, before making the final decision to opt for this scheme, you need to look at the pros and cons of this scheme:

Pros:

- It’s simple and easy to file than filling standard VAT returns

- New businesses can avail 1% discount for the first year

- You can save more money and profit through this scheme

Cons:

- You can only reclaim it on capital purchases, not on domestic purchases

- Exempt income is taxed under this scheme

- Identifying the exact flat rate VAT on your business is difficult

Quick Wrap Up:

To find out whether the scheme is suitable for your business or not, you need to consider your business’s products, revenue and the type of business you’re running.

You should decide wisely for your business growth. So, without waiting any further, contact our qualified VAT accountants and sort out your issues as soon as possible.

Get an instant quote right away!

Disclaimer: This blog post provides general information on the Flat Rate VAT scheme.