25/03/2021Tax Issues , Tax Saving Tips

Establishing a new business is never easy, you need to face a lot of problems while starting a new business. Being a smart entrepreneur, you should try to reduce your expenses and increase your earnings by opting for efficient strategies. This is where you need to know about Entrepreneurs’ Tax Relief. You can use this relief to lower down your Capital Gains Tax (CGT) at the rate of 10% for the business assets that are sold or disposed of.

Entrepreneurs’ Tax Relief- An Overview:

As a business owner, you might wish to sell or dispose of your business due to your hectic routine and many other reasons. In this case, you can claim an allowance to receive a reduced tax rate on your sold assets. This allowance is known as Entrepreneurs’ Tax Relief.

This relief can help you to boost your financial gains by reducing the charges of CGT on the profit you made out while selling your business assets. Nowadays it is renamed by HMRC as Business Asset Disposal Relief.

Whether you’re a freelancer or sole trader, we can fix your all tax issues within a minimum time. Just click here to get an instant quote!

How to Claim and How much to claim?

If you’re a business owner, this relief is one of the most captivating tax benefits for you. You can claim Entrepreneurs’ Tax Relief, which is now known as Business Asset Disposal Relief up to £1 million in your lifetime. If your claim is within the threshold of £1 million, you can claim it multiple times until you reach the limit.

You can claim this relief in two ways:

- Self Assessment tax return

- Completing the Section A form of the Helpsheet Business Asset Disposal Relief

Key Takeaway: If you have disposed of your business in 2010/20, the deadline to claim for this relief is 31 January 2022.

Eligibility for ER:

Individuals are eligible for Entrepreneurs’ Tax Relief. This relief is not available for companies. To qualify for this relief, you need to sell qualifying assets, along with fulfilling other requirements.

You are given a two years qualification period to qualify for this tax relief. For qualification you must follow the below criteria:

- You’re a sole trader and an employee

- You own 5% share and voting rights

- You have not crossed the £1 million lifetime limit

This criterion differs if you sold out your shares or you’re selling your whole/ part of your business. Though, both cases qualify for the EU, you should know the difference.

Seems difficult? We can make it easy! We have a team of professional tax experts for your assistance.

How Does ER Work?

The process is quite simple and easy. Whenever you sell an asset, you are liable to pay tax on it. This tax relief minimizes the amount of tax you pay in terms of Capital Gains Tax (CGT).

Assets that qualify for Entrepreneurs’ Tax Relief:

Including the tangible assets that you sold or disposed of, your shares and securities are also eligible for this relief. However, your investment and personal assets are not eligible for this relief.

How can You work out Entrepreneurs’ Relief?

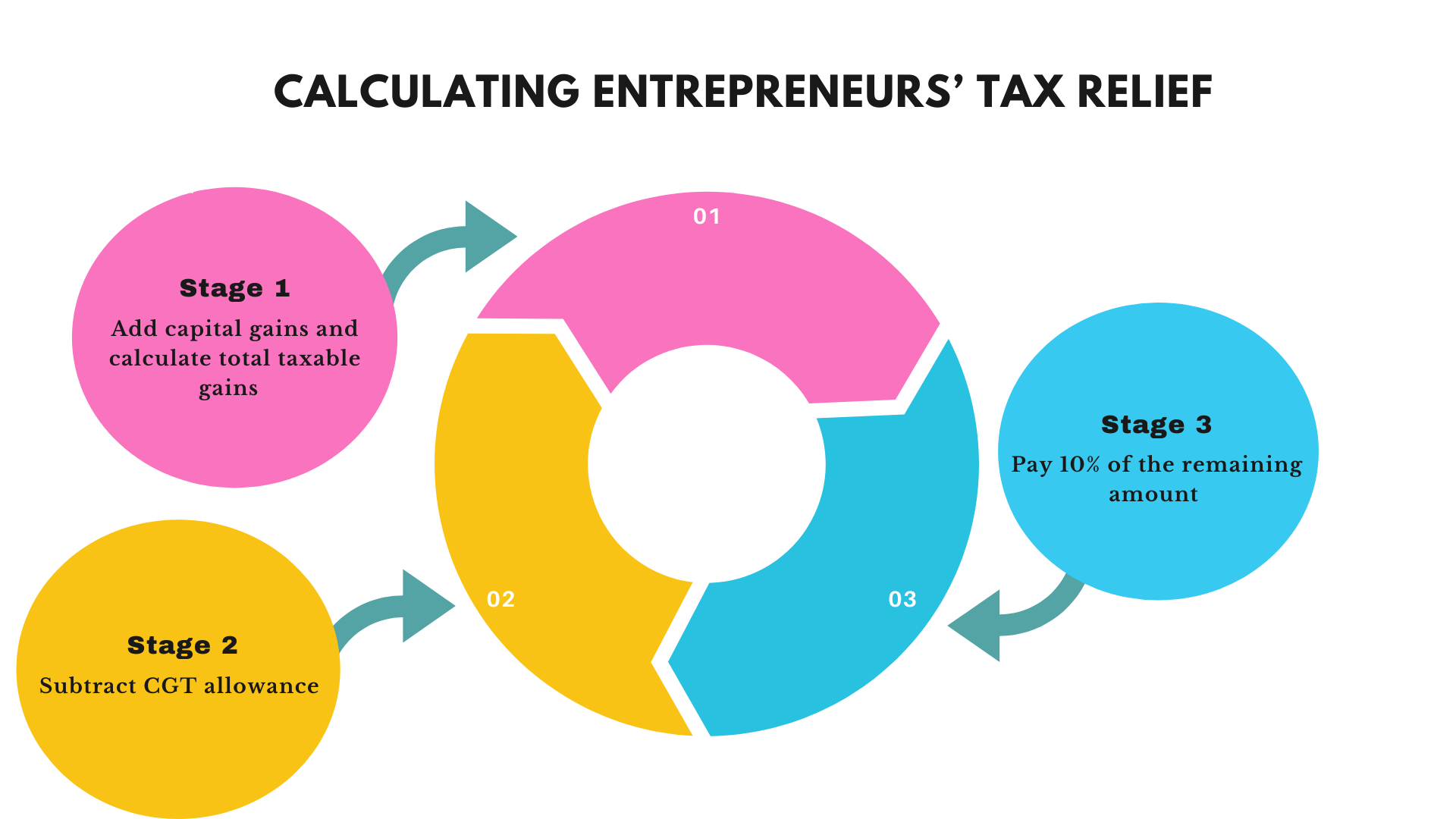

You can calculate this tax relief by following the below steps:

- Add all your capital gains and calculate your CGT

- Subtract it with your tax-free allowance of CGT

- Pay 10% from the remaining amount and the rest is yours

Quick Wrap Up:

We hope you have got enough information about Entrepreneurs’ Tax Relief. You should keep in your mind that the rules and regulations may vary as they change with each passing year. Therefore, you must be up to date with the latest policies and legislation by HMRC. As this will be saving you thousands of pounds.

For further help and assistance, don’t hesitate to contact us for getting expert advice from our qualified chartered accountants in Croydon.