The Enterprise Management Incentive (EMI) scheme offers tax advantages for many SMEs. It’s a share option scheme that allows employees to acquire shares after meeting some conditions. This scheme attracts employees by providing them the opportunity to equally participate in the business.

Continue reading this blog to know more about EMI…!

We have a team of EMI experts who can help you with this scheme, including valuation HMRC filing, vesting schedules, and long-term administration for your company’s growth. We guarantee that working with us will save you time and money!

What is an Enterprise Management Incentive (EMI) Scheme?

The EMI scheme provides a share option, which gives you the right to get shares based on the terms of the agreement. This specifies how many shares a person can acquire, how much each share costs, and when you can get the shares through the exercise of the option.

Option exercise can take place after a particular time of employment. It can also occur when achieving performance targets or when the company is sold.

Why Have EMI Schemes?

If you’re a small business with a limited budget, you might attract staff by offering a share or share option package. Suppose an employee came to know that selling the respective company’s share can result in getting a profitable lump sum. In that case, he or she will join your company even if the compensation package is not above that of competing companies.

As a result of shares grants, employee ownership causes them to be concerned about the company’s interest, just as the employer is. In this way, the entire staff works together to increase the shareholder’s value. They’re all working to grow the company and for increasing the value of the stock and dividends.

Qualifying Companies:

Your company should meet the following conditions to qualify for the EMI scheme:

- Gross assets of £30 million or less.

- Is not amongst the industries excluded by HMRC: banking, farming, shipbuilding, property development, and provision of legal services.

- Containing 249 employees (fewer than 250).

- It is not majority-owned or run by another company.

Eligibility for Employees:

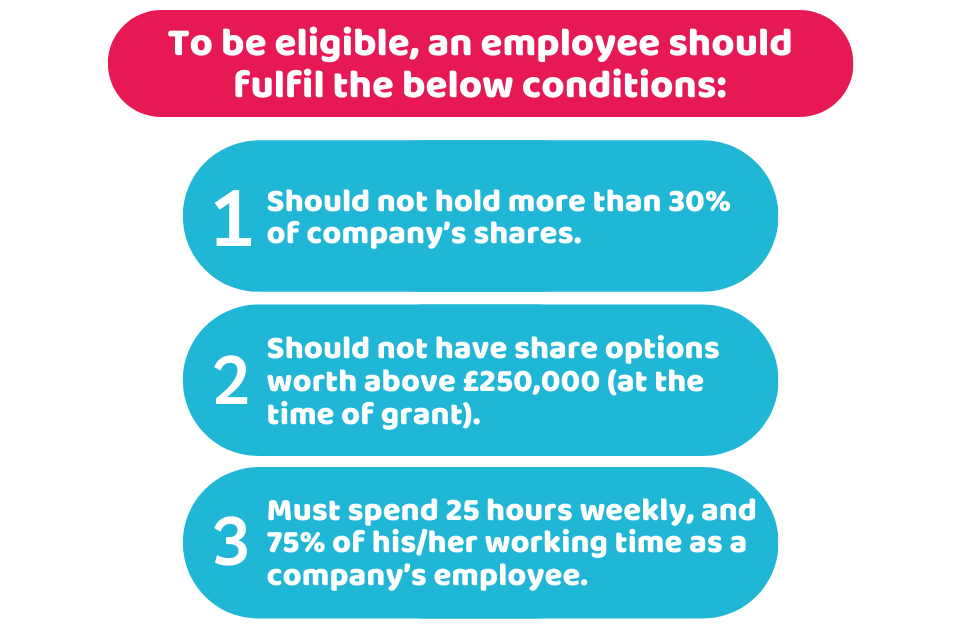

To be eligible, an employee should fulfill the below conditions:

- Should not hold more than 30% of the company’s shares.

- Should not have share options worth above £250,000 (at the time of grant).

- Must spend 25 hours weekly, and 75% of his/her working time as a company’s employee.

Want to register for EMI, contact us right away!

When your Company can Lose the Tax-Advantaged Status?

Your company can lose it if:

- It hasn’t registered for Enterprise Management Incentive within the terms of the legislation.

- The company is unable to inform HMRC about the grant of the EMI option within 92 days.

- The company’s option holders are unable to exercise their option within 90 days because of a disqualifying incident.

The Working of an Enterprise Management Incentive Scheme:

First of all, the company should establish if it is enterprise management incentive qualifying or not with the help of its experienced advisors. In case the company is, then it needs to decide the working of an EMI scheme plan.

EMI is too flexible, but there are some important issues to consider:

- Which employees should be given share options, and how many should they be granted?

- What kind of shares should have options?

- In order to exercise options and to get shares, how much will employees need to pay?

- What happens in case a company’s option holder leaves?

The formal EMI option agreements containing all relevant terms should be prepared once all the issues mentioned above are resolved. The options are formally granted when both the employer and the employee have signed.

Within 92 days, the option grant has to be notified to HMRC.

Quick Sum Up

We would summarise our blog by saying that enterprise management incentive (EMI) options are worth considering for both companies and employees. Companies would face recruitment problems if they do not provide offer options. Therefore, if your company has not implemented an option plan yet, now is the time to do so.

We at CruseBurke provide a full-fledged Package on EMI, including legal/ Tax and valuation requirements with expert advice and in-depth discussions! Contact us now!

Disclaimer: This blog post covers the basic information about EMI.