11/01/2022Accounting , Business , Finance

Wondering what is the difference between revenue and income? Even as a business owner, you may find these accounting terms confusing. Revenue and income can’t be used interchangeably. You need to know both for a better understanding of the company’s expenses and overall financial health.

Learning these accounting terms will help you to keep your bookkeeping up to date, and this data can be used to manage your finances. Among other accounting terms, revenue and income are the key terms you need to have a grasp on.

Let’s look at the difference between revenue and income and how to use income and revenue figures?

If you are stuck with accounting or tax issues? How about speaking to us via a call. We love talking about accounts, taxes, payroll management and opportunities that help you expand your business. Call us on 020 8686 8876 or email us today.

Difference Between Revenue and Income: Quick Overview

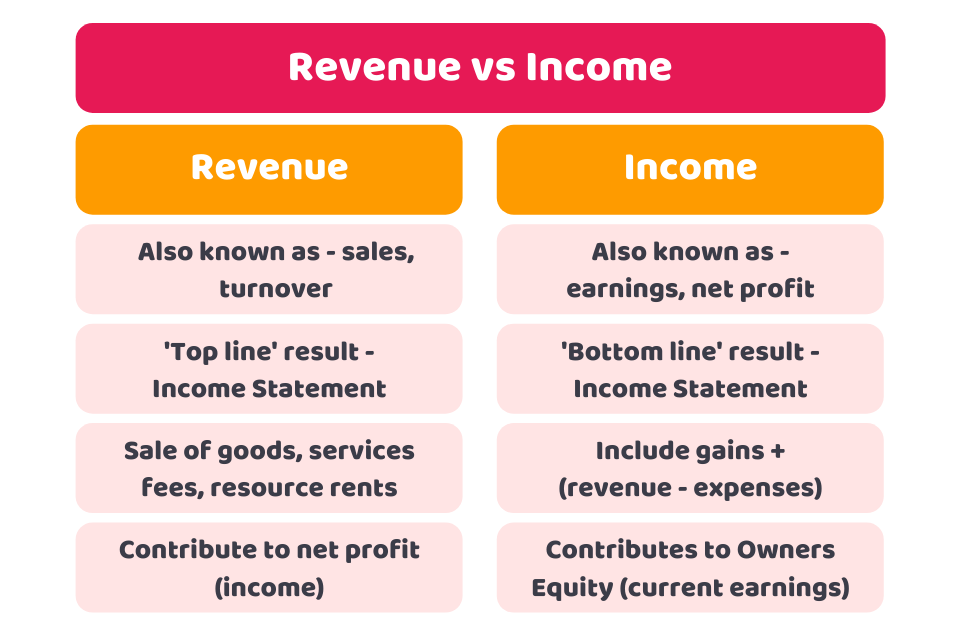

The amount generated from the sale of goods and services or is earned from the company’s primary operations is known as revenue. Revenue (gross sales) is often referred to as the top line, as it is placed on the top line of the financial statement. On the other hand, income or net income is the amount calculated by taking revenues and deducting the cost of doing business, like taxes or other expenses, etc. It shows the business’s total earning or profitability and it is on the bottom line of the income statement.

To better understand the difference, let’s break them down.

Revenue Explained

The revenue of a company refers to the total amount of sales made by a company in a specific period. Referred to as gross sales or top line, it is the amount generated from the main business operations of a business (generally by the sale of goods and services). Here is the list of types of revenue that frequently appear in finance and accounting. These include:

- Sale of goods or items

- Sale of services, like accounting

- Rental income from commercial property

- Money from investments

- The sale of tickets to a concert

- Interest income from lending

Here is the simple formula to calculate the revenue for your business:

Income – Any discounts – Any deductions for returns = Revenue

You can also calculate the revenue by just adding your gross sales without considering any expenses.

Have a query or need more help? Get help from our chartered accountants!

Income Explained

Income or net income is calculated by deducting your operating expenses and depreciation/amortisation from gross revenue. It is also referred to as the bottom line of the income statement, as it shows a full picture of cash flow in and out. The term net income clearly indicates that all expenses are subtracted from it. Typically, there are two main types of income:

- Gross income: Income earned before deducting any expense

- Net income: It is the income you get after deducting all expenses

Here is the basic formula to work out income:

Revenue – Operating Expenses – Depreciation and amortisation = Income

Income determines how efficient a company is at its spending and managing its operational costs. It is one of the important measures to ascertain the profitability of a business.

How to Use Your Income and Revenue Figures?

Both income and revenue can be a great indicator of your business’s profitability. Bear in mind that high sales, don’t always mean that your business is growing as sometimes you can make more sales but may be unable to earn enough to make a profit. There are many reasons for it, like you may be offering a discount or the cost of the goods is equal or lower than their manufacturing cost.

By analysing these figures you can get a better overview of the business growth.

Quick Sum Up

We hope that you have got a good grasp of the difference between revenue and income. Both of them are essential financial metrics to calculate the financial health of your business. These terms are also important in the accounting context to understand how total earnings are reported in accounting. As a whole, learning these accounting terms will help you to understand the expenses, profitability and overall business value.

We save your time, money, and stress by handling all your finances and business problems in no time! Call us on 020 8686 8876 or email us today.

Disclaimer: The information is intended to provide general information.