23/09/2021Business , Finance , Limited Company , Misc

In a defined benefit pension scheme, the amount of money you get in retirement is based on the number of working years for the company and your earned salary. So if you are looking for a significant source to know about DB pension, then you have just found the right post. This blog will inform you about what is DB pension and how it is worked out.

We have skilled financial advisors at CruseBurke that can assist you with pensions and retirement plannings! So, get an instant quote now!

What is a Defined Benefit Pension?

It is also known as a final salary pension. It is a pension scheme that promises to hand over a secure income. This income is based on the number of working years for your company and your final salary at the time of retirement. You will directly get this income, and it will increase every year.

The company for which you have worked until retirement will contribute to this scheme. It will also make sure that there is a sufficient amount of money to pay your pension income at the time of retirement. But, of course, you can contribute to this scheme too.

When you die, your life partner, civil partner, or dependents will continue to get this pension.

What are the Types of DB Pension?

The following are the two types of DB pension.

Final Salary Schemes – It depends on your final salary at the time of retirement

Career Average Schemes – It depends on the average of your salary over your career.

These both types of DB pension provide valuable benefits. Your pension income will increase each year. In this way, it can keep up with the increasing prices in the future. The other benefits of this pension scheme include:

- You will get a full pension in case you get retirement because of poor health.

- Your life partner, civil partner, or dependents will get your pension income in case you die.

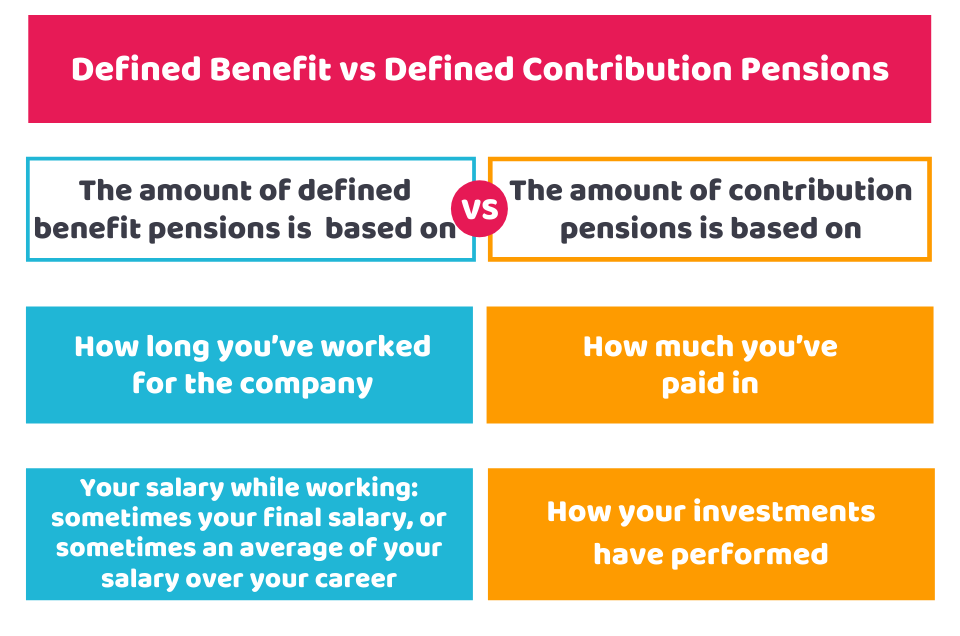

Defined Benefit vs Defined Contribution Pensions

The following infographics will show you the difference between them.

How are Defined Benefit Pensions Calculated?

On behalf of a company, usually, DB schemes are run by trustees. They are responsible for all aspects of this scheme, including paying out income to retired employees.

The scheme administrator carries out the DB scheme’s daily management and then gives the report to the Trustees. These pensions are calculated on the basis of the following:

1) Final Salary Scheme

If you are in this scheme, your pension will be calculated by: Number of years you worked for the company multiplied by the final salary (this could be the average of your salary over your career) divided by a fraction of your pensionable pay.

2) Career Average Scheme

If you are in this scheme, then your pension will be calculated by using a fraction, usually 1/60th or 1/80th.

The final pension will be calculated by summing up all the revalued pension (that is earned in each year over your career).

Final Thoughts

We hope now you understand what is defined benefit pension scheme is and how to calculate it. While calculating your pension income, you need to see whether you are in the final salary scheme or the average career scheme. We recommend you to take professional help in calculating your pension income as it is complex. In addition to that, you may also require professional advice while transferring your pension to your dear ones.

Are you looking for a professional to help you calculate your pension income? Then look no other than CruseBurke! We have a team of skilled chartered accountants and pension advisors that will calculate your pension income as per your salary scheme in no time and at an affordable price! Contact us now!

Disclaimer: This blog contains general information about the DB pension scheme.