21/10/2021Accounting , Business , Limited Company

You are required to set up the chart of accounts (COA) in case you are taking over bookkeeping in your new company. If you do it rightly, your other tasks will be too easier to manage. The foundation of accounting is bookkeeping, and the initial step to managing your accounts correctly is “setting up the chart of accounts.”

It may be challenging to keep a record of your business incomings and outgoings. But, it is important to understand the basics of COA for those who want to know their cash flow and the overall financial position of their company.

Therefore, this blog will let you know about COA, its structure, and its importance. So, let’s explore the details!

At CruseBurke, we have a team of limited company accountants to prepare and file your company’s accounts at a reasonable rate. Reach out to us now!

What is a Chart of Accounts?

The COA contains the list of the company’s financial accounts in the general ledger of your company. It permits you to divide all your business transactions made during a particular time into various subcategories.

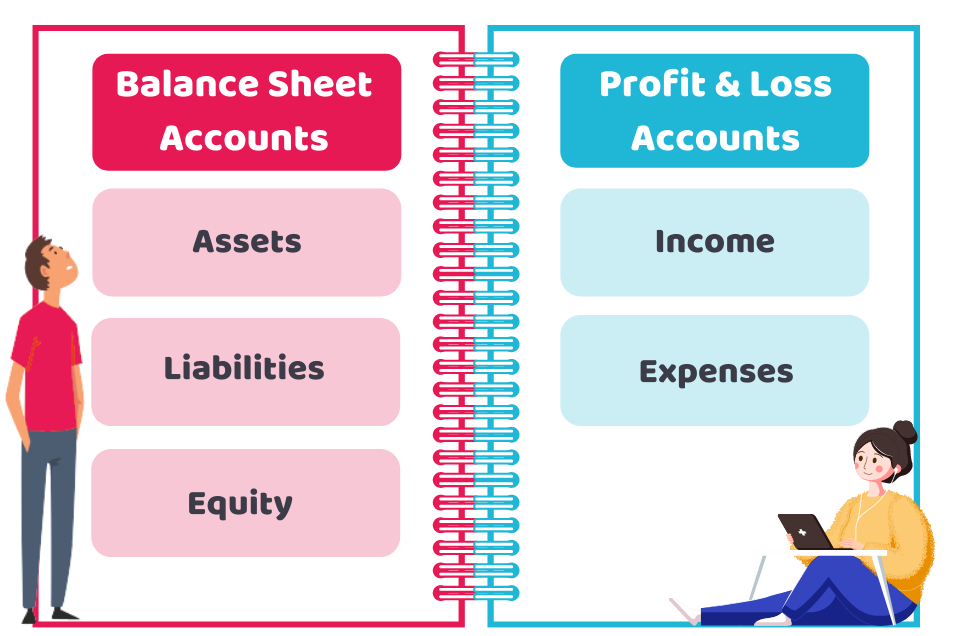

A COA permits you to get an insight into your business’s different areas by separating your income, expenses, assets, and liabilities that are shown in the following infographics.

What is the Structure of COA?

The list splits all the company accounts by the following:

- Where do the accounts belong either in equity, assets, or liabilities

- What financial statement do the accounts go to, either in BS (balance sheet) or income statement?

In order to meet the certain needs of your company, this can be further subdivided. The following is included in the charts of accounts:

Company Assets:

The company assets can consist of the following:

- Allowance for doubtful accounts

- Petty cash

- Accounts receivable

- Marketable securities

- Cash

- Prepaid expenses

- Accumulated depreciation, etc.

- Inventory

- Fixed assets

Company Liabilities:

The company liabilities may include the following:

- Accounts payable

- Taxes payable

- Notes payable, etc.

- Accrued liabilities

- Wages payable

Shareholders’ Equity:

The equity of a shareholder include:

- Capital (cash invested by the owner in the company)

- Drawings ( cash withdrawn by the owner for personal use)

Company Income/Revenue:

The following can be included in the revenue of the company:

1. Income/Revenue

2. Sales returns and allowances

Company Expenses:

The following can be included in company expenses.

- COGS (Costs of goods sold)

- Depreciation

- Payroll tax

- Supplies

- Utilities, etc.

- Bank fees

- Advertising

- Rent

- Wages

Don’t have the time to manage your business finances! Be worry-free and rely on CruseBurke to handle your business finances in the best possible way.

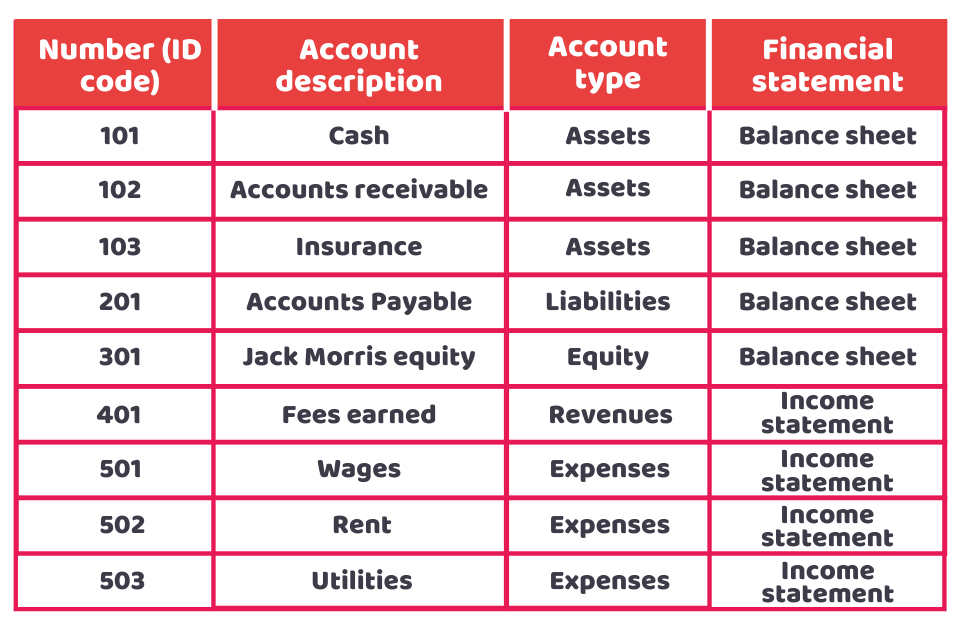

An Example of a Chart of Accounts

The following partial listing represents the distribution of accounts in a COA. The gap between the account numbers allows for future accounts additions.

How is a COA Used in an Accounting Software?

An accounting software deals with the five core accounts (assets, liabilities, equity, revenue, and expenses). They are similar for every company. However, the categories that comes below them in a COA can be customised to fit your company.

For instance, for sales revenue, you can create many accounts. One for every area you deal in, or one for each company department.

Your accounting software can ask you where to record the opposing credit or debit at the time of entering any transaction into it. You can also instruct the software to make the opposing entry for you, automatically.

How to Deal with a COA?

The following are the tips to deal with a chart of accounts.

Make changes timely – It is better to make changes at the end of the accounting year, as adding accounts is easy at any time, but deleting any creates problems.

Keep the COA consistent – Try to consider the comprehensive COA’ structure for your new business in order to keep your accounts organised, right from the start. This will help you to compare the accounting date for the future.

Go on optimising your COA – Don’t be afraid to fix the structure of your COA, if it has become inconvenient. And for better bookkeeping, you are required to add other types of accounts.

Quick Sum Up

We hope now you have understood what is a chart of accounts, its structure, and how to deal with it. We would sum up our discussion by saying that it is essential to know COA basics for those who are setting up a new business. This is because managing your company accounts well can grow your business. Therefore, it is preferable to consult a skilled accountant to set up your COA for your new company.

Unable to set up a chart of accounts for your new business? Let us handle this! We are skilled chartered accounts that can manage your business accounts in no time, at an affordable price, and we’ll grow your business like never before! So, contact us right away!

Disclaimer: This blog contains general information on a COA.