23/11/2021Tax Issues , Taxation , VAT

When setting up a new business, some people may think that it is necessarily important to register for Value Added Tax (VAT). But, you need to know that it is not mandatory to register, provided that your VAT taxable turnover is over £85,000 (VAT threshold). However, even if your annual turnover is below the threshold, you can still register for it voluntarily as it comes with a lot of advantages. There are a lot of benefits of being VAT registered. As it helps your new or emerging business to appear more professional and stable in the business world.

So before we delve into the benefits of being VAT registered, let’s see what is VAT?

Want to register for VAT? We’ll take care of everything from scratch to acquire your VAT number. So, fill out this form and leave the rest on us!

What is VAT?

VAT, Value Added Tax is a consumption tax on products and services collected by businesses on HMRC’s behalf. All businesses having a VAT taxable turnover of over £85,000 need to register for it. For businesses that are VAT registered, VAT is charged on the majority of all goods and services they provide. In addition, this tax is also charged on the goods and services imported from EU or non-EU countries.

This tax is added to the sale price of things sold to commercial and non-commercial businesses. Businesses that are VAT registered can claim back the VAT paid to their suppliers or other businesses.

Now let’s see the benefits of being VAT registered!

Benefits of Being VAT Registered

This question is often asked by many new businesses that why there is a need to register for it if their turnover is below the VAT threshold. There are many advantages of doing so as it has a lasting impact on the financial health of your business.

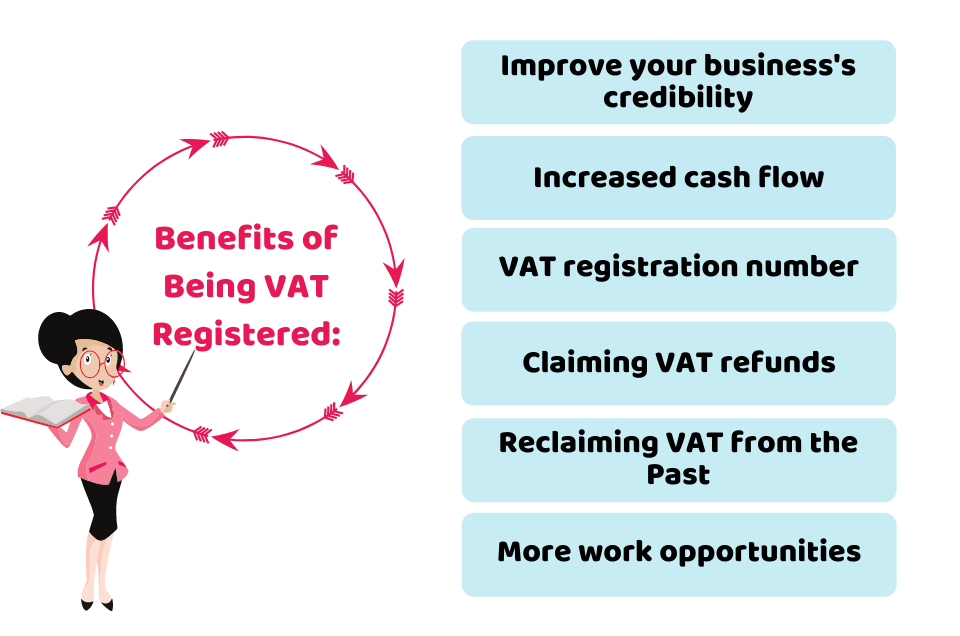

There are a lot of benefits of being VAT registered:

Improve Your Business’s Credibility

To appear an established business and to improve your perception, you should consider registering for VAT voluntarily. As many businesses know that £85,000 is the VAT registration threshold. If your business is not VAT registered, your competitors will know that its turnover is lower than the VAT threshold. So, it is a great way to improve business credibility and to appear a large business in the eyes of your clients and competitors.

Access to VAT Registration Number

By registering for VAT, you can display your VAT registration number on all the business documents, and its website to show the public that you are a VAT registered business. It improves your credibility and provides others with a trustworthy image of your business.

Increased Cash Flow

One of the other benefits of VAT registration is better cash flow. Once your business is VAT registered, you can claim back your VAT costs. The higher your set-up costs, the more you can claim them back. All the costs you put in on your business like getting stocks, investing in technology, or getting professional services, so getting these costs back can be a life-saving step.

Claiming VAT Refunds

Your business will be able to reclaim the VAT that you paid for. If your input tax (VAT paid) exceeds the output tax (the VAT you charged), you can claim the difference from HMRC. When you invest in buying machinery, plant or equipment, you can reclaim a large amount of VAT. While submitting your VAT return, you may find that you can reclaim a lot from the HMRC.

Need professional advice from a VAT accountant? Get in touch with our experts today!

Reclaiming VAT from the Past

Once you are registered for VAT, you can get the advantage to claim VAT for the last 4 years on the things you still use. To do it, you need to be VAT registered for a considerable time and keep all the records, invoices and receipts of the past 4 years.

More Work Opportunities

Many investors, buyers, lenders, and clients prefer to work with VAT registered business. So by registering, you will open doors to more business opportunities to widen your business spectrum.

Quick Sum Up

Now that you are well aware of the benefits of being VAT registered, you can improve the position of your business by registering for VAT. You can register for it directly on HMRC’s website or by filling out the VAT1 form. However, the process can be daunting, therefore allow us to register your business for VAT to avoid the hassle.

Register For VAT today!!!

CruseBurke offers inclusive VAT services at a reasonable price! Contact our qualified VAT accountants and sort out your VAT issues in no time!

Get an instant quote right away!

Disclaimer: This blog provides general information on the benefits of being VAT registered.