23/08/2021Pension

Wondering what is auto-enrolment pension? It is the government initiative aimed to boost your retirement savings where the employer and government also put money into your pension pot. All employers in the UK need to offer this workplace pension by automatically enrolling their eligible employees. It is meant to encourage people to save money for a comfortable retirement.

Read on this blog to find out:

- What is an auto-enrolment pension?

- Am I eligible for auto-enrolment?

- How much do I have to contribute?

- Can I opt-out of the scheme?

Whether you’re a business owner or a sole trader, our team of qualified accountants at CruseBurke offers the best financial services and solutions for your business. Reach out to us now!

What is an Auto Enrolment Pension?

Introduced in 2012, auto-enrollment is the legal requirement for employers to set up a workplace pension; add all the eligible employees into it, and contribute to their savings. Before 2012, employees used to decide whether they wanted to join the pension or not.

Since then, more than 10 million people have been auto-enrolled and are saving into their pension pot for their retirement. Consequently, lots of people are saving for their future. They’ll get this money back when they stop working or reach the retirement age of 55.

Am I Eligible for Auto Enrolment?

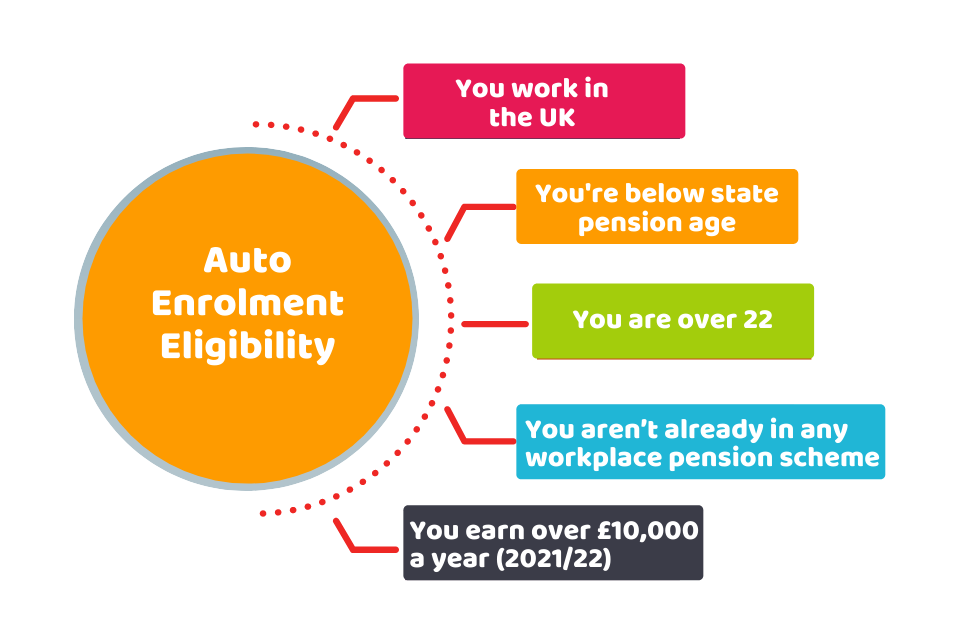

No matter whether you’re a full-time worker or a part-time worker, your employer needs to enrol you in a workplace pension, if you meet the below rules:

- You work in the UK

- Below state pension age

- You are over 22

- You aren’t already in a suitable workplace pension scheme

- Earn over £10,000 a year for the tax year 2021/22

If your earnings are below £10,000 but over £6,240 in 2021-22, your employer is not liable to enrol you automatically into this scheme. However, you can still request your employer to add you to this scheme, which can’t be refused.

If you meet the above criteria for auto-enrolment, you’ll still be eligible for it if:

- you’re on a short-term contract

- you’re away on maternity, carer’s leave

- you’re getting payment from an agency

How Much do I have to Contribute?

The contribution amount to workplace pension varies based on the income you earn. As you need to contribute a certain percentage of your income. So the more income you have, the more pension you need to pay. There is a three-way contribution to this scheme. First by you, second by your employer and third by the government.

Generally, you need to pay 5% of your income and your employer needs to pay at least 3% of it. The government will contribute to it by providing you with tax relief. It applies to anything you earn above £6,240 up to a limit of £50,270 (2021/22). It means if you earn £20,000 annually, you need to contribute 5% out of £13,760 ( £20,000 – £6,240).

Depending on the scheme rules, there are some employers who apply the minimum pension contribution from your total earnings, not only on the £6,240 (qualifying earning). Moreover, you can ask your employer to find out how much you need to contribute.

Worried about the tax implications on pension payment? Get in touch with our accountants and tax experts to sort out your issues!

Can I Opt-Out of the Scheme?

After being enrolled, you have the choice to opt-out. However, by opting out, you’ll lose the contribution both from your employer and the government.

To opt-out, you can ask for the form from the pension provider and provide that opt-out form to your employer (not to one who runs the scheme). You’ll only get the refund when you opt-out within a month after being enrolled, otherwise you’ll get the refund at the time of your retirement.

You can rejoin the scheme whenever you want. Legally, your employer can re-enrol you after three years. You have to wait for three years, even if you meet the eligibility criteria.

Quick Sum Up

So, by reading this post you have got answers to few important questions: what is an auto-enrolment pension, are you eligible for it, how much you need to contribute and can you opt-out from it or not. In case, if your employer is not complying with the rules of the auto-enrolment scheme, the pension regulator can levy fines and take action to ensure the contribution payment. However, at the first stage, you need to talk to your employer to resolve the issues. If not resolved, then you can contact the Pension Regulator to investigate the concern in case of non-payment or missing contribution by your employer.

Need help? CruseBurke has a team of accountants, bookkeepers, and tax experts for taking care of your finances and pension contributions. Contact us today!

Disclaimer: This blog is written for general information on auto-enrolment pension.