30/09/2021Business , Finance , Limited Company

Small businesses need to know about accounts payable and accounts receivable and their differences because helps them to get a better knowledge of their accounting process. In the world of business, where often you need to buy goods on credit, while you may also sometimes be needed to sell out them on credit. That is where the procedures and processes of accounts payable and receivable take place.

This blog will let you know about the importance and differences between these two terms.

Reduce your business burden by allowing our accountants to establish your company within 3 hours! Contact us now!

What are Accounts Payable and Accounts Receivable?

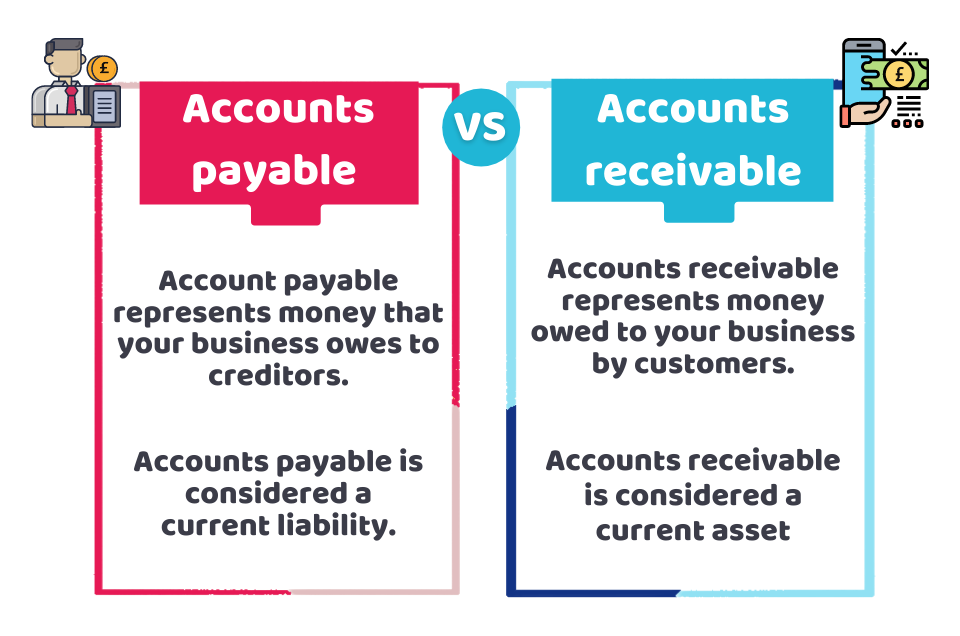

Accounts payable (AP) is an account on the general ledger of a company that shows an obligation to pay the liability (debt) to its suppliers or creditors. When transacting with a third party, accounts payable keeps a record of all the funds a company owner is obliged for. That is why it is considered a liability account. A mortgage is an example of it.

Accounts receivable (AR) refers to the invoices that are owed to a company, typically by customers. It is a current asset account in which the company keeps track of the amount of money it has a legal right to take from customers (who receive goods or services on credit).

Interest receivable is an example of an accounts receivable transaction. You get it from keeping the amount in an interest-bearing account or making investments.

Now that you know what are these accounts let’s explore their differences.

Difference Between Accounts Payable and Accounts Receivable

Through the following infographics, you will know about the main difference between these two terms.

Contact CruseBurke’s skilled accountants if you require assistance from an accountant or tax specialist.

What are the Steps Associated with Accounts Payable?

The following are the five essential steps that are linked with the accounts payable process.

1) Receival

A company will get an invoice requesting payment after it buys services or goods from another business.

2) Record

Into the accounts payable ledger, a record of that invoice. This process should be automatically performed through OCR (Optical Character Recognition) and invoice scanning if you have accounting software.

3) Match

The invoice may require to be matched with the shipping receipts, a purchase order, and/or an inspection report, depending on your process.

4) Approval

In order to make sure that the payment is accepted as a liability, the invoice must go through an approval process and a set of controls.

5) Payment

The last step is to make sure that the invoices get paid in the correct amount and on time.

What are the Steps Associated with Accounts Receivable?

The accounts receivable process flow is quite simple. However, the following are the three essential steps an accounts receivable team needs to go through when looking for payment.

1) Send

An invoice is straight away sent to the customer after all work has been accomplished.

2) Track

Through a trial balance, invoices are regularly tracked. Reminders are sent out when payment is not received. Other actions such as collections or phone calls may be taken as well.

3) Receival

The accounts receivable department will make sure that the payment that has been received is correct. After ensuring, it will record that payment as “paid” in the ledger.

Final Thoughts

We will conclude our blog by saying that understanding accounts payable and accounts receivable is essential for business owners, especially when starting out and doing multiple transactions with credit. Both terms play an important role in the cash flow of a company. Therefore, you must be able to identify both processes in order to reduce stress in the long term.

Don’t have time to operate your company’s finances? Then, put your mind at ease and trust CruseBurke to take care of your company’s finances. Please feel free to contact us right away!

Disclaimer: This article intends to provide general information based on accounts payable and accounts receivable.